Bitcoin value breaks $90,000, however the funding fee on Binance is detrimental. Will BTC/USD break $100K as merchants pour in?

Bitcoin is surging, buying and selling at early March 2025 ranges. Spectacular as this uptick is, merchants on Binance, the world’s largest crypto alternate by consumer rely, aren’t totally on board but.

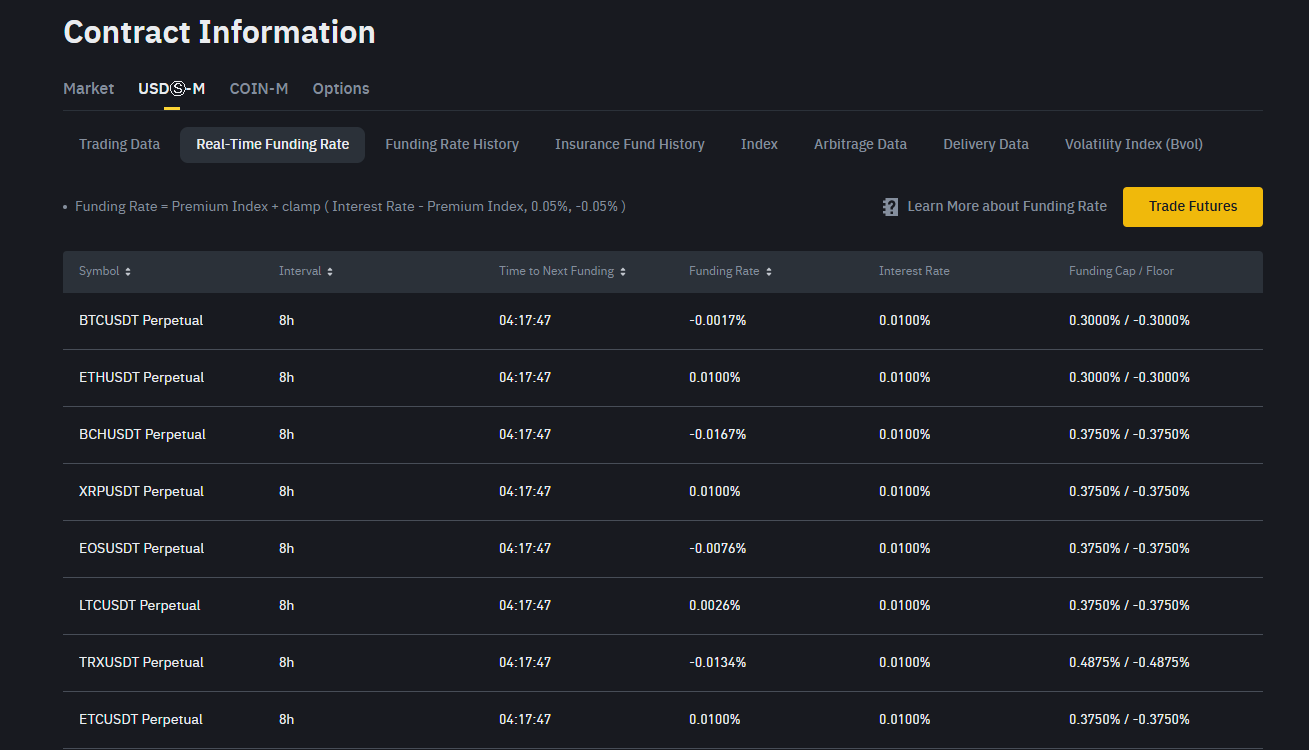

On X, one analyst famous that the Binance funding fee stays detrimental, a marked divergence displaying that, regardless of rising costs, there hasn’t been a large influx or FOMO driving demand.

BINANCE TRADER IN DISBELIEF !

Do not sleep on this, we don’t get setups like this fairly often.

Whereas Bitcoin is delivering a every day efficiency of almost 5%, traders on Binance do not appear to consider this rally will final.

Whiereas BTC continues to climb, funding charges on… pic.twitter.com/l9PDV8IhtY

— Darkfost (@Darkfost_Coc) April 22, 2025

For knowledgeable merchants monitoring market exercise over the previous few years, this divergence isn’t simply noise. It’s a sign that Bitcoin, and by extension altcoins, could also be getting ready for a large rally.

EXPLORE: 10 Greatest AI Crypto Cash to Spend money on 2025

The Contrarian Catalyst on Binance?

To grasp why that is essential, one should grasp what funding charges are in crypto.

Funding charges are periodic funds between brief and lengthy merchants in crypto perpetual markets. Whereas they assist hold the index shut to identify charges, additionally they gauge sentiment.

When funding charges flip optimistic, lengthy merchants pay sellers, indicating that purchasing the underlying asset is at a premium. When detrimental, as is at present the case, sellers pay consumers, pointing to bearish positioning and common skepticism.

Usually, funding charges flip detrimental when costs fall. Nonetheless, they’re at present detrimental regardless of Bitcoin trending greater, breaking above $90,000.

(Supply)

This improvement on Binance suggests merchants are skeptical about whether or not bulls can push costs even greater.

Traditionally, the analyst notes, skepticism about bullish energy tends to gasoline main value rallies and curiosity in among the greatest cryptos to purchase. Furthermore, such occurrences are uncommon, based mostly on value information.

Capitalize on Rare Bitcoin Value Signals?

In mid-October 2023 and early September 2024, funding charges turned detrimental whereas costs surged, previous rallies that lifted Bitcoin to recent highs.

After October 16, 2023, Bitcoin soared from $28,000 to $73,000, and in September 2024, the sign appeared earlier than BTC/USD spiked from $57,000 to $108,000.

(BTCUSDT)

If historical past repeats, the present Bitcoin value disconnect might set the stage for an additional vertical breakout.

From the worth chart, native resistance lies on the psychological $100,000 mark and the all-time excessive of $109,000, serving as rapid targets.

There are hints that merchants are able to push costs greater.

On X, an analyst famous that previously 72 hours, over 57,000 BTC in new positions price greater than $5.3 billion have been opened.

Over the past three days, positions totaling 57,000 BTC have been opened within the futures market, price $5.345B on the present fee. That is the most important liquidity enhance previously 12 months. pic.twitter.com/VE08w0ZvhQ

— Axel

Adler Jr (@AxelAdlerJr) April 23, 2025

That is the most important liquidity injection previously 12 months, an indicator that the breakout above $90,000 may very well be institutionally pushed.

Coinciding with that is the growth within the Bitcoin progress fee, a metric evaluating present versus common entry costs.

First inexperienced spike – a sign that the market has reached peak progress velocity: the worth is rising sooner than the common entry value of all prior holders, thereby making a speculative premium. pic.twitter.com/0aa1dlm9J6

— Axel

Adler Jr (@AxelAdlerJr) April 23, 2025

This velocity of progress signifies aggressive new capital inflows, with speculators keen to pay premiums far above historic averages for publicity.

The spike on this metric suggests Bitcoin could also be within the early phases of a bull run which will additionally assist funnel capital to among the hottest presales in 2025.

DISCOVER: Subsequent 1000x Crypto – 11 Cash That May 1000x in 2025

Bitcoin Value Surging But Funding Rate Is Negative

- Bitcoin surges previous $90K for the primary time in over a month

- Binance funding fee is detrimental, signaling skepticism

- Prior to now, divergences like these have preceded sharp value positive factors

- Will BTCUSDT retest $109,000?

The publish Bitcoin Rallying But Funding Rate Negative: A Classic and Rare Bull Signal Not to Miss? appeared first on 99Bitcoins.