Distinguished crypto analyst Ali Martinez has recognized the instant necessary Bitcoin (BTC) worth ranges utilizing the MVRV excessive deviation pricing bands mannequin. Notably, the premier cryptocurrency has remained in consolidation between $101,000 – $104,000 for a lot of the week regardless of information of a 90-day tariff pause between the US and China.

Pricing Bands: Subsequent Resistance At $116,900, Help At $98,131

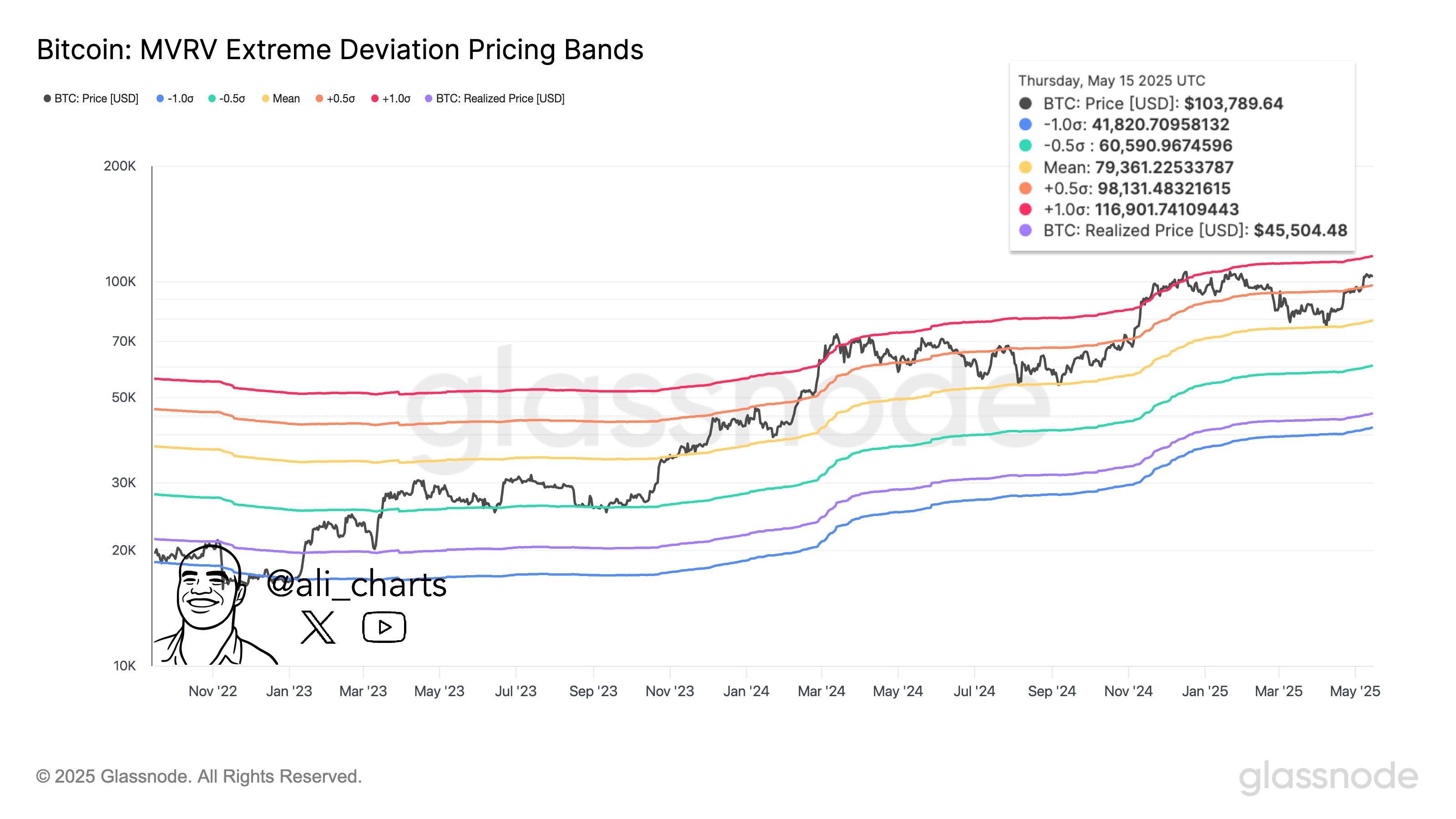

The Bitcoin MVRV excessive deviation bands are statistical bands based mostly on normal deviations of the MVRV ratio from its historic imply. They assist establish excessive overvaluation and undervaluation within the Bitcoin market, and thus are helpful instruments in mentioning resistance and help ranges.

In response to the chart offered by Ali Martinez on Could 16, Bitcoin’s subsequent main resistance lies at $116,901, which aligns with the +1σ (normal deviation) MVRV band. A worth break above this degree would signify a dangerous overvaluation of BTC’s worth and an overheated market, hinting at a lot potential for revenue taking.

However, the premier cryptocurrency’s instant help is round $98,131, represented by the 0.5σ MVRV band. A sustained worth motion above this degree would point out that Bitcoin stays in a bullish valuation zone. However, a worth break beneath this degree would recommend cooling momentum or open the door to deeper retracements.

In the meantime, the imply MVRV band stands at $79,361 and serves as a good worth anchor. If BTC costs fall to this degree, it might current the perfect accumulation alternative for a possible market rebound. Nevertheless, worth falls to decrease MVRV bands at -0.5σ ($60,590) and -1σ ($41,820) would point out bearish retracements and cycle bottoms, respectively.

Bitcoin Holders Sit On 120% Unrealized Positive aspects

In different information, Martinez’s MVRV pricing bands chart additionally exhibits that Bitcoin’s realized worth at the moment stands at $45,504. With the present market worth, this knowledge means that the common BTC investor is sitting on important unrealized positive factors potential as excessive as 120%.

At the time of writing, Bitcoin trades at $103,529 following a 0.87% decline within the final 24 hours and 0.10% prior to now week amidst the continued market consolidation. Nevertheless, the premier cryptocurrency is up by 22.62% prior to now week as bullish forces stay dominant.

Presently, Bitcoin’s subsequent resistance lies on the $105,000, a convincing worth shut above which might spur an extra rise to the present all-time excessive round $109,000. If BTC efficiently breaks by each resistance ranges, it might enter worth discovery territory, doubtlessly accelerating positive factors towards the projected goal round $117,000.

Featured picture from iStock, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.