Bitcoin worth is in bear arms as we speak and yesterday. BTC is at present hovering round $88,000 and buying and selling at 20% beneath the ATH of $109,900 on the time of writing.

When crypto sees a drop like this, worry can overcome rationality and purpose. An excellent dealer should hold a stage head and keep away from involving feelings, not FOMOing into trades. One of the simplest ways to try this is by doing an evaluation many times.

Take a look at the date of CZ’s tweet beneath! On Dec seventeenth, 2020, the each day candle on Bitcoin closed at $22,780.

Many individuals discovered it unbelievable that BTC would attain such costs again then. Because it seems, it had a number of extra x’s earlier than topping out at $69,000.

Ready for the brand new headline: #Bitcoin “CRASHES” from $101,000 to $85,000.

Save the tweet.

— CZ BNB (@cz_binance) December 17, 2020

DISCOVER: Crypto Tendencies For Bullrun

Bitcoin Price Evaluation: BTC USD Evaluation Earlier than Catalysis

What do you imply, bro, what catalysis?

Catalysis in chemistry is the method of including a catalyst to facilitate a response.

In buying and selling, worry is the catalyst to FOMOing into trades. You recognize what FOMO means.

A choice pushed by worry is never a very good determination. It’s quite a response.

As I wrote above, the easiest way to keep away from doing that’s by opening the charts and beginning to attract traces. Earlier than persevering with, please revisit my earlier article.

(BTCUSDT)

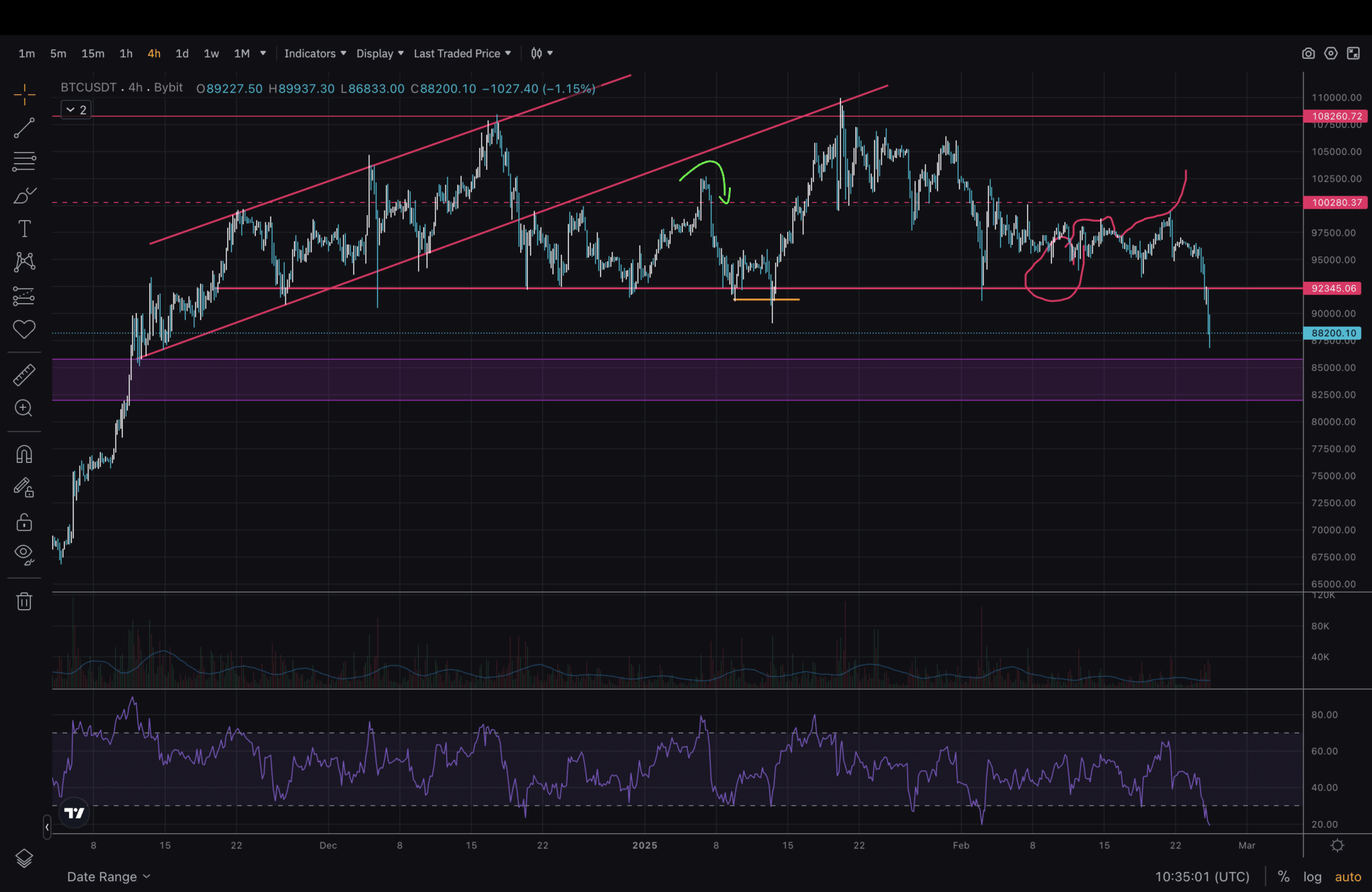

Immediately, we’ll begin by taking a better look and regularly zoom out. The 4H chart exhibits a pointy worth drop after it broke beneath the assist line of $92,400.

In case you opened the earlier article, you noticed the inexperienced arrow was the place the worth was at. Since then, there was a faux breakdown of assist, reclaim, and one other run in the direction of the highs. It efficiently fooled individuals into coming into lengthy positions.

Following the chart, the worth went again to assist, and it regarded prefer it was going to push above the mid-range, however as an alternative, it reversed swiftly. In consequence, longs have been getting liquidated or closed yesterday and as we speak. The liquidated longs exceed $1,300,000,000!

Lastly, on this timeframe, we see that RSI is within the oversold space.

(BTCUSDT)

Bitcoin’s Bullish BTC USD Construction Not Damaged

Subsequent, we take a look at the Every day chart. The purple field is the hole on the left, which I mentioned in my earlier article. It didn’t appear like the Bitcoin worth would drop to that stage, however issues modified shortly in simply two days! And now it seems like this may very well be a doable reversal space.

Peeking at RSI once more, it’s coming into oversold now, too. The road at $73,500 is the excessive from the Spring of final yr, which was examined once more earlier than the worth broke and entered discovery. That is the bottom I’d like the worth to go, not decrease – with a view to keep a bullish construction.

(BTCUSDT)

Subsequent, only a fast look over Fib Retracement on the 1D. A classical instrument that works nicely for crypto evaluation. It aligns to a excessive diploma with the degrees within the earlier chart. 0.618 can be a terrific stage to bounce off, because it sits in the course of that hole.

(BTCUSDT)

Final, we’re zooming out the furthest, wanting on the Weekly chart. The RSI bearish divergence was one sign to think about this retrace a risk. One other is the 4 wicks above $104,600 and the shortcoming to shut above.

Swing failure and deviations are what occurred up there. Nonetheless, this chart seems the most effective by way of pattern. I’ll be keeping track of the 40-45 RSI stage to carry.

EXPLORE: Finest Decentralised Exchanges

Key Takeaways From Bitcoin Price Evaluation

- Bitcoin continues to be in bullish pattern regardless of upwards of 1.3 billion price of lengthy liquidations.

- Key space between 82,000 and $86,000 .

- BTC worth bulls need to hold worth above $73,000, which is methods beneath.

The publish Bitcoin Price Heads South: Where Can BTC USD Find a Bottom? appeared first on 99Bitcoins.