Bitcoin is at the moment consolidating just under its $112,000 all-time excessive, with bulls firmly defending the $108,000 stage as short-term assist. This slim vary has created a tense however bullish setting as merchants and buyers await a decisive transfer that would form the market’s course within the months forward.

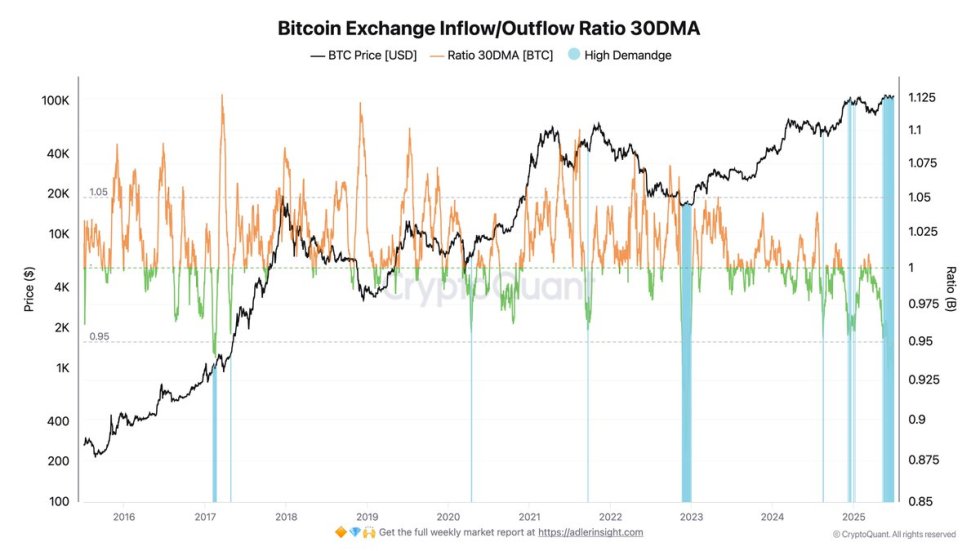

Prime analyst Darkfost highlights a notable pattern: outflows proceed to dominate, reinforcing long-term investor confidence. This sample means that quite than exiting the market, seasoned holders are transferring BTC off exchanges, sometimes an indication of lowered promoting strain and powerful conviction.

It’s not tough to see why confidence is constructing. Bitcoin adoption is steadily rising amongst main companies and authorities establishments alike. The digital asset is now not seen purely as a speculative instrument however is more and more being positioned as a long-term retailer of worth. From company treasury methods to nation-state curiosity, Bitcoin is step by step changing into embedded in broader monetary infrastructure.

Bitcoin Vary-Certain As Long-Term Confidence Builds

Bitcoin is at the moment buying and selling inside a decent vary between $103,000 and $110,000. This vary has continued for a number of weeks, making a buildup in momentum that means a breakout is imminent. A decisive transfer above $110K may push Bitcoin into worth discovery, whereas a breakdown beneath $103K would possible set off an accelerated draw back. For now, the market stays in wait-and-see mode.

Macroeconomic uncertainty is starting to ease, with extra readability rising round rate of interest coverage and international development expectations. Many analysts imagine {that a} new bullish part may unfold within the coming months. Nonetheless, dangers stay. US Treasury yields are climbing as soon as once more, and inflation continues to point out indicators of persistence—two variables that would dampen market sentiment in the event that they worsen.

Regardless of these headwinds, long-term investor confidence seems sturdy. Darkfost notes that outflows are as soon as once more dominating the market. The month-to-month outflow/influx ratio has fallen to 0.9, a stage not seen because the depths of the 2023 bear market. A ratio beneath 1 sometimes alerts sustained demand on the spot market, as cash are being withdrawn from exchanges quite than ready on the market.

This habits displays rising conviction amongst long-term holders. Bitcoin is more and more being embraced by companies and even governments as a strategic reserve asset. It’s step by step evolving right into a modern-day retailer of worth, used to bolster treasury allocations and scale back publicity to fiat foreign money dangers.

As outflows proceed and adoption grows, Bitcoin’s long-term fundamentals stay intact. The present vary could solely be a pause earlier than the following main transfer—one that would outline the trajectory of the market heading into Q3 and past.

BTC Consolidates Under Resistance

The three-day Bitcoin chart exhibits continued consolidation just under the $109,300 resistance stage, with assist holding agency close to $103,600. This vary has outlined latest worth motion, and the low volatility hints at an impending breakout. Notably, BTC stays properly above its key transferring averages—the 50 SMA at $95,655, the 100 SMA at $90,529, and the 200 SMA at $73,817—suggesting the bullish pattern stays intact on the upper timeframe.

Regardless of repeated exams, patrons have but to interrupt above $109,300 with conviction. Nonetheless, the sequence of upper lows since mid-April signifies constant bullish strain constructing beneath resistance. A breakout above the $112K all-time excessive would mark a significant technical shift and push BTC into worth discovery, with upside momentum possible accelerating quickly.

Quantity stays comparatively low, indicating market contributors are ready for a catalyst to verify course. Till then, merchants are possible watching for one more retest of the decrease boundary of the vary or a decisive transfer above resistance. So long as BTC maintains its present construction and key assist holds, bulls stay in management. A detailed above the resistance zone would set the stage for the following leg up on this bullish cycle.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.