After reaching a three-month excessive of $103,800 on Friday, Could 9, the worth of Bitcoin had a gradual begin to the weekend earlier than resuming its run towards $014,000. Whereas the premier cryptocurrency continues to carry above the $100,000 mark, market individuals seem to belief the coin to make a play for recent highs over the approaching weeks.

Curiously, the Bitcoin miners, who’ve grow to be more and more reactionary because the fourth halving in 2024, appear to even have renewed confidence within the value of BTC. The newest on-chain information reveals that the miners have been holding onto their property in latest weeks, coinciding with the coin’s newest value rally.

Are Bitcoin Miners Making ready For An Prolonged Rally?

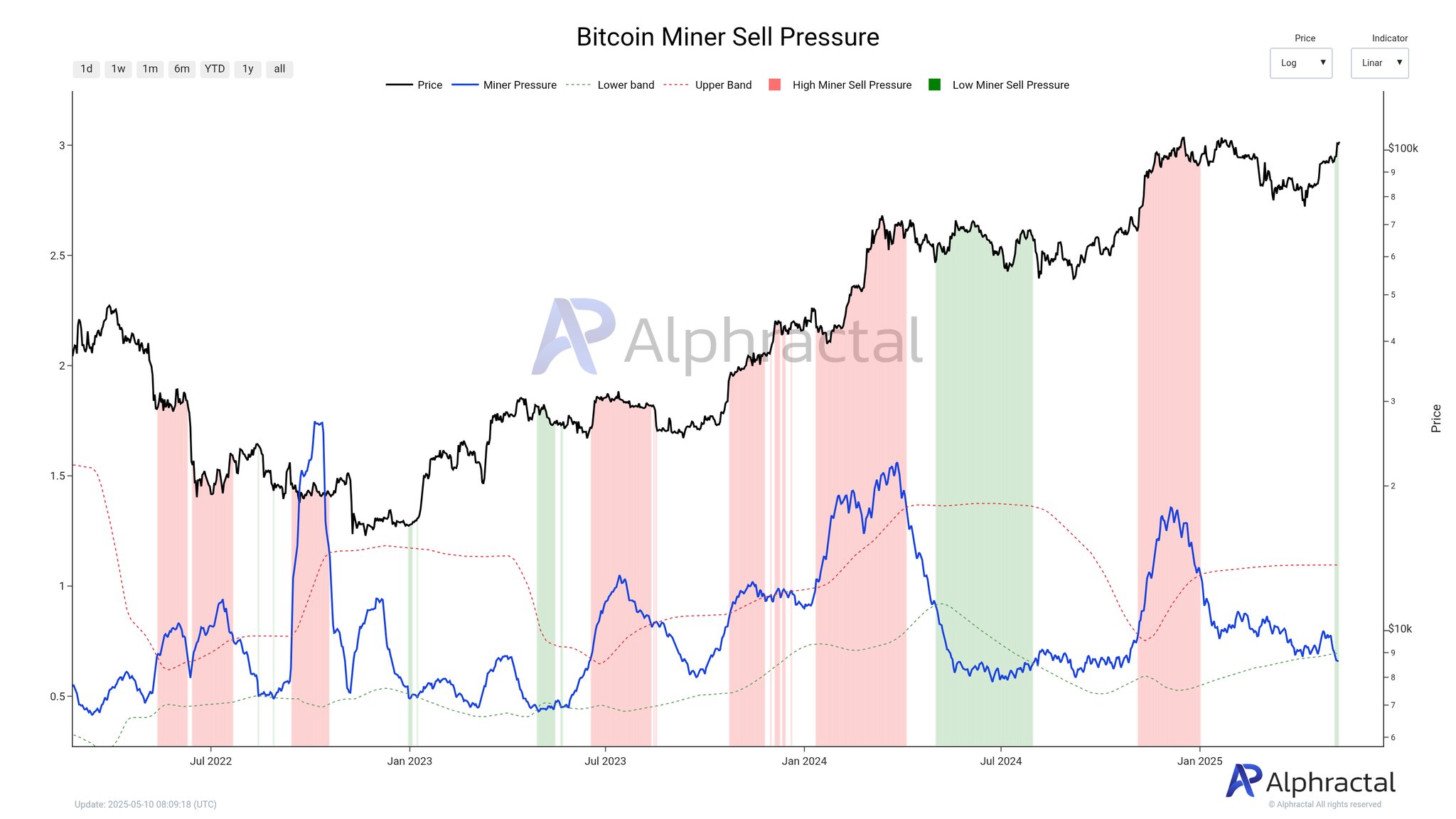

In a Could 10 publish on X, crypto analytics platform Alphractal revealed that Bitcoin miners have gotten much less energetic available in the market, accumulating their mining rewards relatively than promoting them for revenue. The related indicator right here is the Miner Promote Pressure metric, which measures the promoting power of Bitcoin miners over a given interval.

This metric compares the full BTC outflows from miners over the previous 30 days with the common quantity of cash of their reserves inside the identical interval. The Miner Promote Pressure indicator offers invaluable perception into the habits and sentiment of a related group of community individuals.

Within the highlighted chart, the pink coloration represents excessive promoting stress amongst these Bitcoin miners and is commonly correlated with a sluggish market situation. The inexperienced coloration, alternatively, displays a low miner promote stress, which could possibly be a optimistic signal for the worth of Bitcoin.

Supply: @Alphractal on X

As proven within the chart above, the Miner Promote Pressure metric enters the pink territory when the Miner Pressure transferring common (blue line) crosses above the higher band (pink line) — signaling intense bearish stress from miners. In the meantime, the Miner Pressure line crosses beneath the decrease band (inexperienced line), suggesting low promoting stress from miners.

In line with information offered by Alphractal, the Miner Pressure line not too long ago crossed beneath the decrease band, suggesting that the community miners have been holding on to their cash in latest weeks. The on-chain analytics agency added that this metric is at its lowest stage since 2024, as miners appear to be ready for the Bitcoin value to say recent highs.

Whereas the Bitcoin market has considerably matured such that miners’ promoting doesn’t have that a lot vital influence on costs, an prolonged interval of low promoting stress from the community individuals could possibly be naturally bullish for the premier cryptocurrency. Alphractal, nevertheless, famous that the market might even see renewed promoting curiosity as costs transfer within the coming weeks.

Bitcoin Value At A Look

As of this writing, the worth of BTC stands at round $104,250, reflecting an over 1% rise up to now 24 hours.

The value of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.