Recently, the Bitcoin market has been seeing some notable changes in its value and key metrics whilst volatility continues to overshadow the broader crypto market. With constructive developments rising out there, bullish momentum seems to be constructing as the worth reclaims the $85,000 mark once more.

CME Open Interest Decline Hints At Consolidation Phase

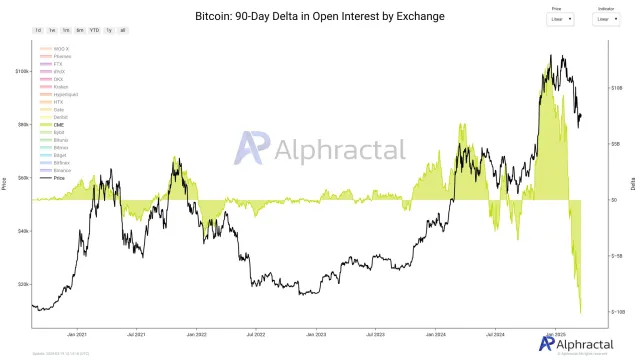

Bitcoin’s value is gaining traction resulting from rising bullish sentiment out there. Previous to the renewed value shift towards the upside, BTC’s CME Open Interest has declined considerably up to now few months, indicating a slowdown in institutional buying and selling exercise.

Alphractal, a complicated funding and on-chain information platform highlighted that the latest drop in open curiosity is the most important that flagship asset has ever seen. This substantial decline signifies that merchants could also be adopting a cautious strategy in gentle of ongoing market uncertainties and value fluctuations.

A fall in open curiosity sometimes implies a shift in habits, with some traders abandoning holdings. The event coincides with a renewed upward transfer, signaling that the market could be cooling off after a protracted bearish efficiency.

After inspecting the Bitcoin Open Interest Delta metric within the 90-day timeframe, the platform famous that the drop is valued at round $10 billion. Such a notable worth displays the massive positions closed by institutional traders over the 3-month interval.

Whereas the 90-day Open Interest Delta reveals a pointy drop, the 30-day Open Interest Delta appears to have stopped its descent. Moreover, the Open Interest Delta within the 7-day timeframe is now transitioning into constructive territory.

In different phrases, the BTC CME information remains to be pessimistic within the medium time period, whereas positions appear to be getting into a consolidation part within the quick time period. In this situation, promoting strain is prone to scale back within the quick time period regardless that it’s nonetheless current within the general view.

To this point traders are monitoring the pattern’s affect on BTC as costs transfer to problem key resistance ranges. It is because the market’s response to this drop in open curiosity may pave the best way for Bitcoin’s subsequent main transfer.

New BTC Whales Are Entering The Market

Current information exhibits that new Bitcoin whales are getting into the market despite the drop in open curiosity. Market skilled Onchained revealed that pockets addresses holding at the very least 1,000 BTC are aggressively accumulating extra cash, which alerts robust confidence in its long-term prospects. This persistent shopping for displays a rising demand for the asset amongst institutional and high-net-worth gamers.

Over time, these holders have established themselves as a number of the most vital gamers out there with a complete of 1 million BTC acquired since November 2024. Their accumulation price has considerably elevated because the whales bought 200,000 BTC this month alone in latest weeks.

Featured picture from Unsplash, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.