Following an in depth value correction previously three months, the Bitcoin bull market continues to hold within the stability. Regardless of a modest value rebound in April, the premier cryptocurrency is but to show a powerful intent to renew its bull rally amidst a scarcity of constructive market elements. Nonetheless, crypto analyst Axel Adler Jr. has highlighted a promising improvement that might sign main upside potential for Bitcoin.

Bitcoin Lengthy-Time period Holders Wanting To Halt Selling Pressure

In a latest put up on X, Adler Jr. shared an necessary replace in Bitcoin long-term holders (LTH) exercise, which might show considerably constructive for the broader BTC market.

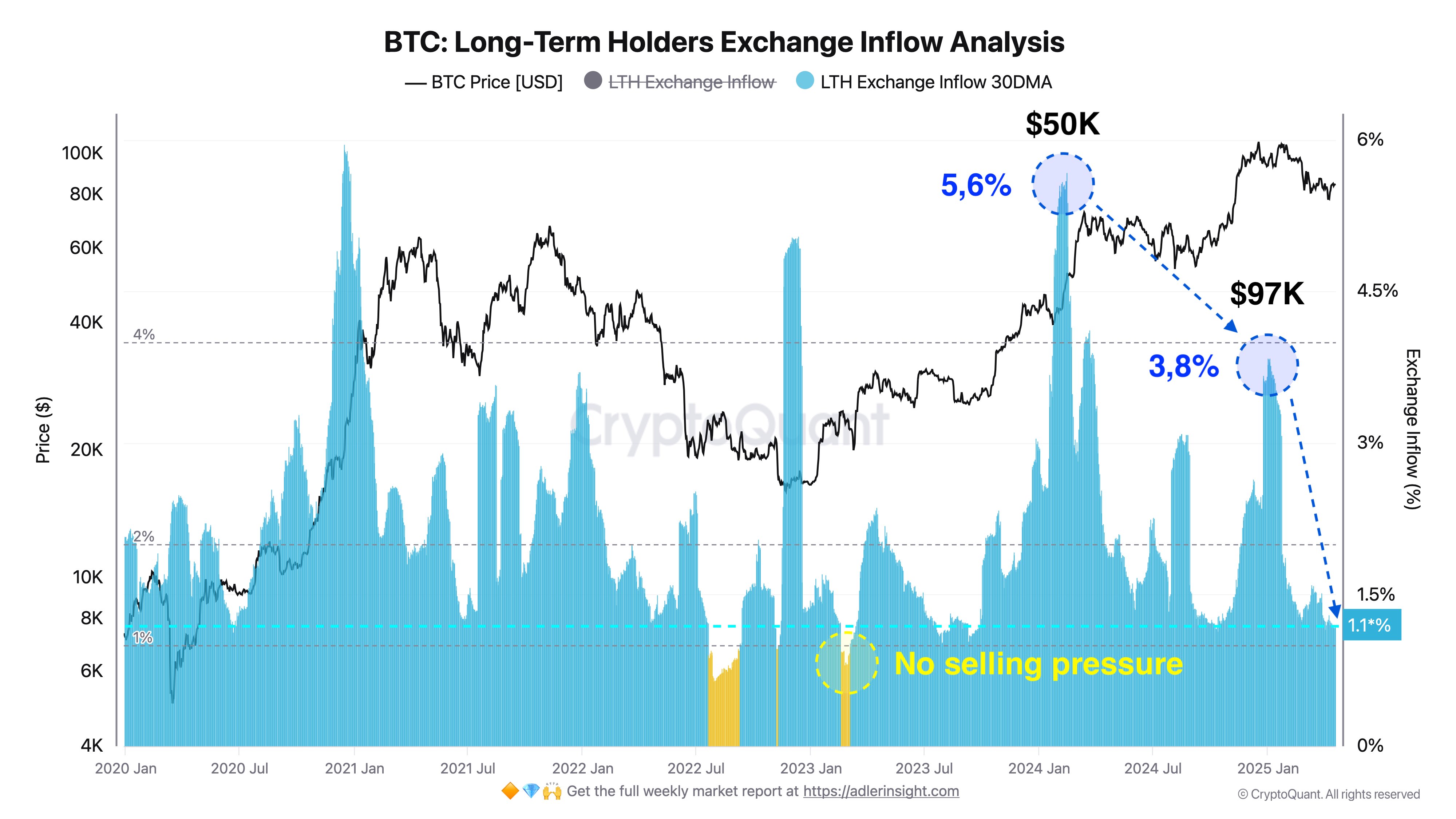

Utilizing on-chain information from CryptoQuant, the famend analyst reviews that promoting strain by long-term holders, i.e. quantity of LTH holdings on exchanges, has now hit its lowest level at 1.1% over the previous yr. This improvement signifies that Bitcoin LTH at the moment are opting to carry on to their property moderately than take income.

Adler explains {that a} additional decline in these LTH trade holdings to 1.0% would sign the whole absence of promoting strain. Notably, this improvement might encourage new market entry and sustained accumulation, creating a powerful bullish momentum within the BTC market.

Importantly, Alder highlights that almost all of the Bitcoin LTH entered the market at a median value of $25,000, Since then, CryptoQuant has recorded the best LTH promoting strain of 5.6% at $50,000 in early 2024 and three.8% at $97,000 in early 2025.

In keeping with Adler, these two situations seemingly characterize the first profit-taking phases for long-term holders who meant to exit the market. Due to this fact, a resurgence in promoting strain from this cohort of BTC buyers is unlikely within the short-term, which helps a constructing bullish case as long-term holders at present management 77.5% of Bitcoin in circulation.

BTC Worth Overview

On the time of writing, Bitcoin was buying and selling at $85,226 following a 0.36% acquire previously day and a 0.02% loss previously week. Each metrics solely replicate the continued market consolidation as BTC continues to battle to attain a convincing value breakout past $86,000.

In the meantime, the asset’s efficiency on the month-to-month chat now displays a 1.97% acquire, indicating a possible pattern reversal because the market correction ceases. Nonetheless, BTC stays in want of a powerful market catalyst to ignite any sustainable value rally. With a market cap of $1.67 trillion, Bitcoin is ranked as the biggest digital asset, controlling 62.9% of the crypto market.

Featured picture from Adobe Inventory, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.