Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

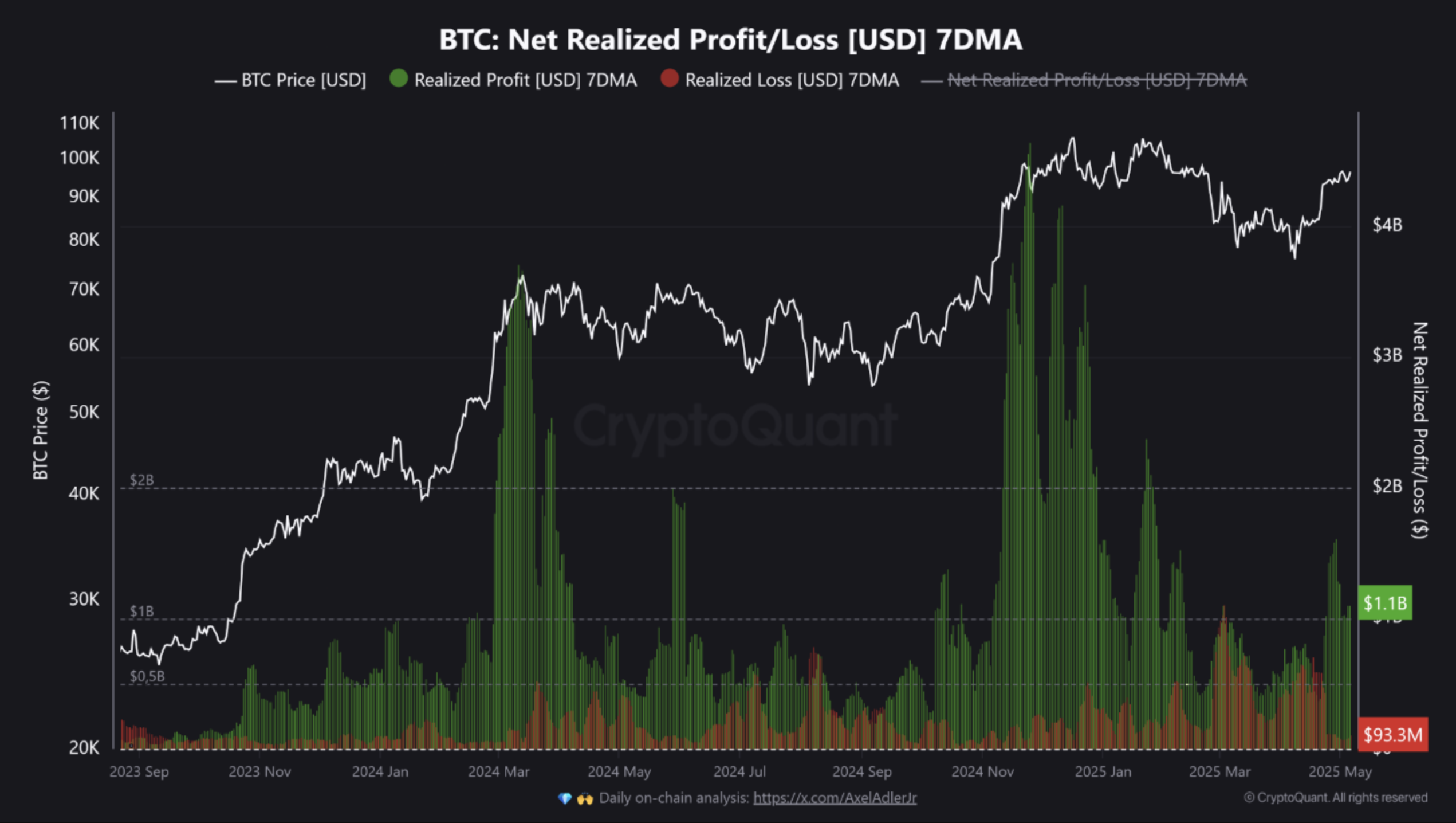

In accordance with a latest CryptoQuant Quicktake put up, Bitcoin (BTC) buyers are aggressively taking income following the most recent surge within the digital asset’s worth. This uptick in profit-taking mirrors investor habits usually seen throughout the late phases of a bull market.

Bitcoin Revenue-Taking Rises – A Trigger For Fear?

Bitcoin’s 7-day transferring common (MA) web realized revenue/loss has principally remained constructive since early 2024. The metric surged as excessive as $1 billion a day because the flagship cryptocurrency pushed in the direction of new all-time highs (ATH) final yr.

Though BTC skilled a pointy downturn between March and April 2025, profit-taking remained sturdy as Bitcoin recovered most of its losses. The asset is presently buying and selling within the mid-$90,000 vary.

Associated Studying

CryptoQuant contributor Kripto Mevsimi famous that such sturdy realized income – at the same time as costs rise – usually sign a late-stage bull market. Drawing comparisons to the 2021 market cycle, Mevsimi identified that comparable patterns preceded a neighborhood high.

Nevertheless, the launch of spot Bitcoin exchange-traded funds (ETFs) in January 2024 has altered the market construction to a fantastic extent. That mentioned, investor psychology has remained the identical in that profit-taking patterns nonetheless align with historic patterns, although now with higher velocity and quantity.

Mevsimi shared a number of attainable eventualities that will play out available in the market. First, If realized income stay excessive, the chance of a pointy correction will increase. This will likely push BTC again towards $90,000.

Quite the opposite, if profit-taking declines, it might point out the beginning of a market cycle transition. Both method, short-term volatility is anticipated to rise. The put up provides:

The sign shouldn’t be calling a full macro high, however it’s flashing a neighborhood warning zone. As all the time: zoom out, and observe habits — not simply worth.

BTC Might See A Momentary Pullback

In the meantime, seasoned crypto analyst Ali Martinez warned that BTC could retest the $97,700 resistance forward of at the moment’s Federal Open Market Committee (FOMC) assembly, which might set off one other short-term pullback.

Moreover, Bitcoin’s provide shortage narrative is being questioned. Whereas trade reserves proceed to dwindle, latest on-chain information suggests a provide squeeze is unlikely within the close to time period.

Associated Studying

In comparable information, Bitcoin’s demand momentum is but to recuperate from destructive territory. Current information exhibits that market individuals are nonetheless favoring short-term hypothesis over holding BTC for the long-term.

That mentioned, momentum indicators just like the Bitcoin Stochastic RSI are displaying renewed power, bolstering the case for BTC to achieve a brand new ATH. At press time, BTC trades at $97,248, up 3.4% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, X, and Tradingview.com