Bitcoin has not too long ago been buying and selling inside a traditionally slim 60-day value vary. Right here’s what normally follows such durations of compressed volatility.

Bitcoin Worth Motion And Provide Are Each Constrained In A Tight Range

In a brand new submit on X, the on-chain analytics agency Glassnode has mentioned how BTC hasn’t witnessed a lot sharp value motion not too long ago. Beneath is the chart shared by the analytics agency that exhibits the historic cases the place the 60-day value vary was narrower than the present one (when it comes to proportion swing).

Appears like there have not been many cases of a tighter value vary in historical past | Supply: Glassnode on X

From the graph, it’s seen that there have solely been a number of durations the place the asset has traded between a narrower vary throughout a 60-day interval than the final two months. This highlights simply how tight the worth motion has been for Bitcoin not too long ago.

Interestingly, the cases with a extra compressed value vary all led to particularly unstable durations for the asset. Thus, it’s attainable that the newest stale interval may additionally find yourself unwinding with a very sharp swing within the cryptocurrency.

The volatility decompression after a slim vary hasn’t all the time been bullish; nonetheless, the well-known November 2019 crash, which marked the underside of that cycle’s bear market, occurred after traditionally stale motion within the coin’s worth.

The tight value vary isn’t the one indication that Bitcoin could possibly be as a consequence of volatility within the close to future, as Glassnode has identified {that a} important proportion of the BTC provide is concentrated across the present value degree.

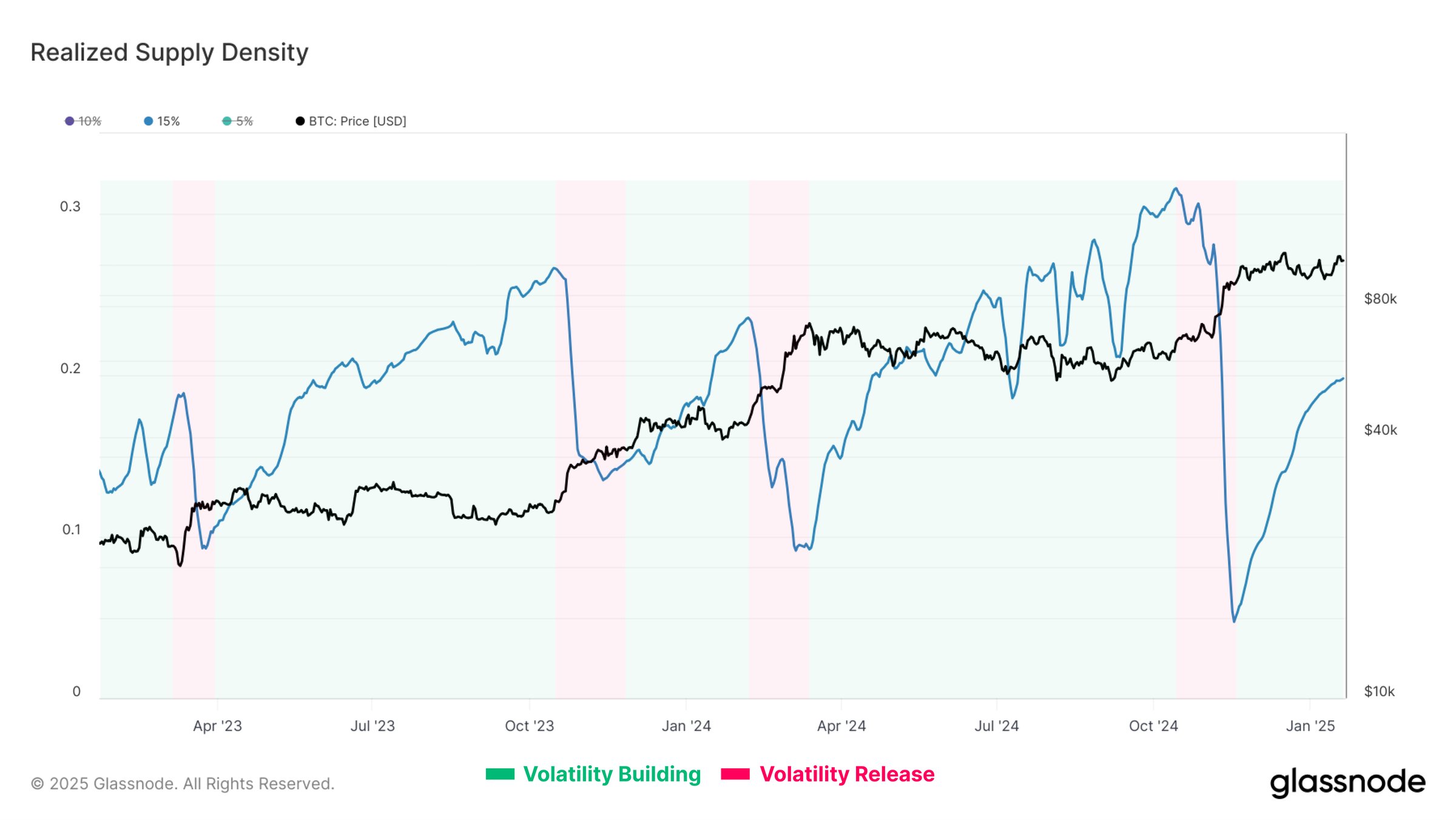

The information for the Realized Provide Density within the +15% to -15% value vary | Supply: Glassnode on X

The above chart exhibits the info for the “Realized Supply Density,” which is an on-chain metric that tells us in regards to the proportion of the asset’s provide that was final bought inside a given vary surrounding the present spot Bitcoin worth.

In the graph, the analytics agency has chosen 15% because the vary, which means that the indicator is displaying the quantity of the provision that was final transferred between +15% and -15% from the newest value.

The Realized Provide Density for this value vary has traditionally adopted a curious sample: a gradual ascent in its worth has corresponded to a “volatility building” section for BTC and a subsequent sharp decline to a “volatility release” one.

Lately, Bitcoin has been inside the previous section from the attitude of this indicator. Round 20% of the BTC provide is concentrated within the ±15% vary proper now, which is a notable worth. “This creates the potential for amplified market volatility as investor profitability shifts,” notes Glassnode.

BTC Worth

On the time of writing, Bitcoin is floating round $105,700, up greater than 5% during the last seven days.

Appears like the worth of the coin has seen an uplift through the previous day | Supply: BTCUSDT on TradingView

Featured picture from iStock.com, Glassnode.com, chart from TradingView.com