Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

In accordance with CoinGecko’s 2025 Q1 Report, the cryptocurrency market, led by Bitcoin, misplaced almost one-fifth of its worth within the first quarter of 2025, absolutely negating the positive aspects made in the direction of the top of 2024.

Associated Studying

Whole market worth witnessed a drop of $3.8 trillion to $2.8 trillion, an 18.6% decline over the quarter. This sharp plunge marked the turnaround earlier than the inauguration of Donald Trump as US president, in stark distinction to final 12 months’s ramp up. Buying and selling quantity additionally suffered some contractions, because the each day volumes dropped to $146 billion, a lower of 27%.

Bitcoin Guidelines Market Whereas Others Decline

Bitcoin insulated itself moderately from the turbulence in different cryptocurrencies in order that its market share reached almost 60%, the best in 4 years. Bitcoin achieved peak valuation at $106,182 in January shortly after inauguration however plunged virtually 12% to complete the quarter at $82,514.

In contrast with Bitcoin throughout this era, gold and US Treasury bonds had been conventional safe-haven investments with decrease efficiency.

In comparison with Ethereum, nonetheless, the state of affairs was a lot worse. Its value fell by 45%, basically wiping out all positive aspects in 2024. Its market share dropped to virtually 8%, the bottom it has been because the finish of 2019.

Because it has been noticed by most analysts, this downturn will not be one thing new since an increasing number of actions have shifted towards “Layer 2” networks constructed atop Ethereum and never utilizing the Ethereum fundamental community.

Meme Cash Crash After Main Rip-off

The beforehand red-hot meme coin area acquired a impolite wake-up name in early 2025. Following a increase in Trump-themed tokens, the business was severely damage when the Libra token – launched by Argentina’s President Javier Milei – proved to be a rip-off.

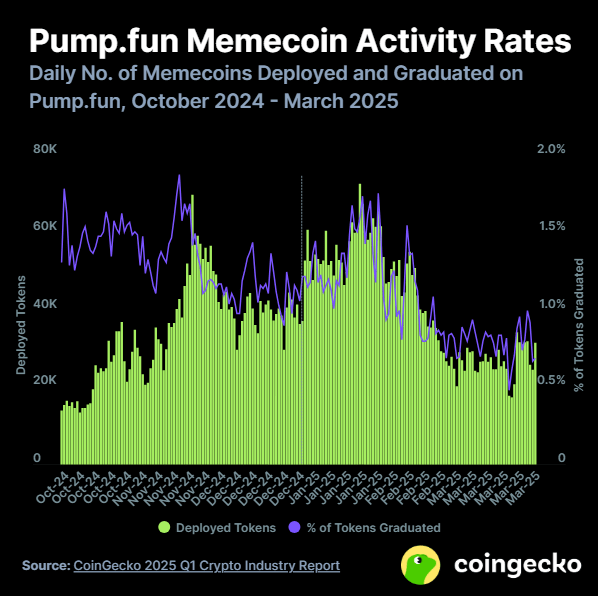

The undertaking was deserted by builders after they’d taken buyers’ funds, shattering confidence in such tokens. By late March, new token launches on the platform Pump.enjoyable per day had dropped by over 50%.

DeFi Industry Loses Extra Than A Quarter Of Its Worth

Not even the decentralized finance (DeFi) business was exempted. Total cash in DeFi tasks dropped 27% to $48 billion throughout the first quarter. Ethereum’s dominance within the DeFi area declined to 56% by quarter-end.

Associated Studying

Not all the things was detrimental, although. Stablecoins comparable to Tether (USDT) and USD Coin (USDC) grew to become extra in style with buyers looking for a safer wager because the market tanked.

Solana additionally remained in its management place, holding 39.6% of all decentralized trade (DEX) buying and selling throughout Q1, courtesy principally of meme coin mania. Even Solana’s management, nonetheless, began to wane on the finish of the interval because the meme coin mania declined.

The dramatic shift in market sentiment exhibits how shortly cryptocurrency fortunes can change. After a promising finish to 2024, the brand new 12 months introduced a harsh actuality examine for crypto buyers, with almost $1 trillion in market worth disappearing in simply three months.

Featured picture from Pexels, chart from TradingView