Since hitting a brand new all-time excessive in January, Bitcoin (BTC) has struggled to determine a bullish kind leading to a downtrend that has lasted during the last two months. In response to distinguished market analyst Egrag Crypto, the premier cryptocurrency may doubtless stay in correction for the following few months earlier than launching a value rally.

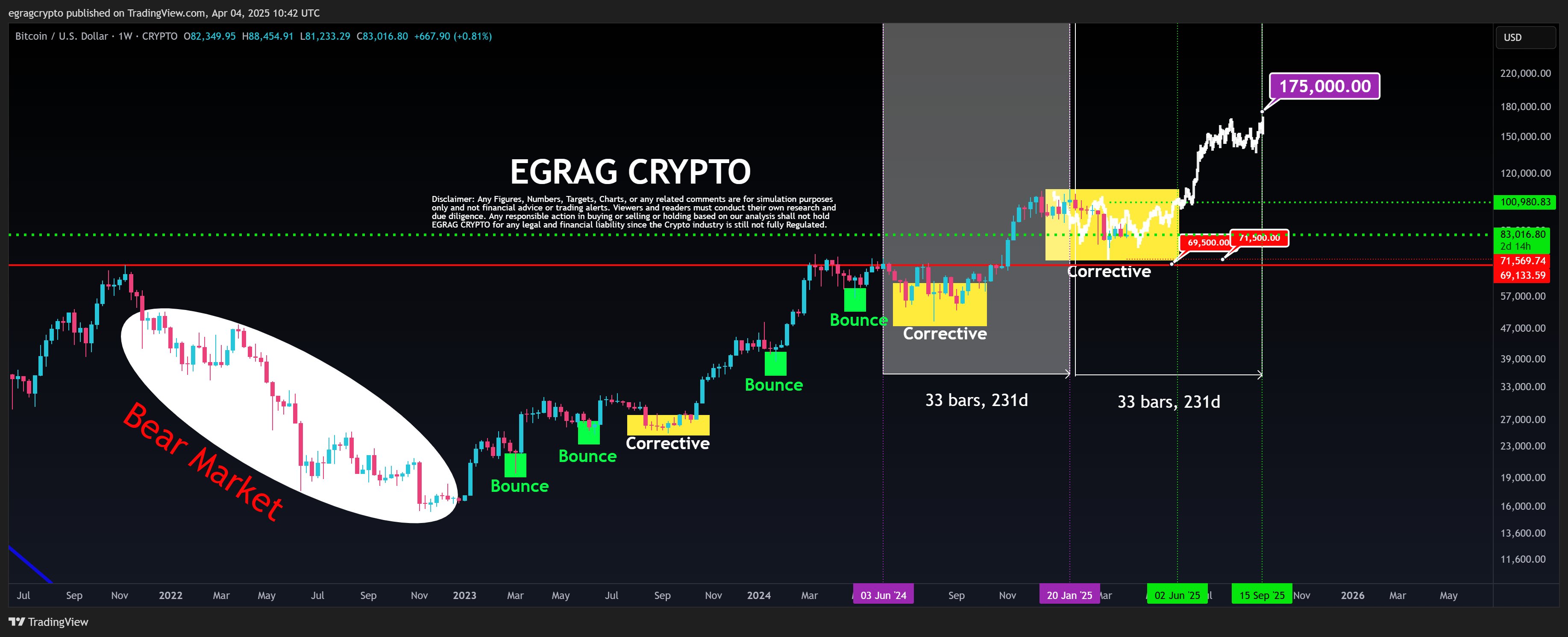

Bitcoin’s 231-Day Cycle Hints At $175,000 Target By September

Following an preliminary value decline in February, Egrag Crypto had postulated Bitcoin may expertise a value correction as a consequence of a CME hole earlier than experiencing a value bounce. Nevertheless, the shortage of sturdy bullish convictions over the previous weeks has compelled a conclusion that the premier cryptocurrency is caught in a doubtlessly lengthy corrective section.

In response to Egrag in a current submit, Bitcoin’s ongoing correction aligns with a fractal sample i.e. a repeating value construction that has appeared throughout a number of timeframes. This sample is predicated on a 33-bar (231-day) cycle throughout which BTC transits from a corrective section to an explosive value rally.

In evaluating earlier cycles to the present creating one, Egrag has predicted Bitcoin may doubtlessly escape of its recalibration by June. In this case, the analyst expects the crypto market chief to hit a market high of $175,000 by September, hinting at a possible 107.83% achieve on present market costs.

Nevertheless, in igniting this value rally, market bulls should guarantee a breakout above the stiff value barrier at $100,000. Then again, any potential fall beneath the $69,500-$71,500 assist value degree may invalidate this present bullish setup and probably sign the top of the present bull run.

BTC Investors Wait As Trade Exercise Slows Down

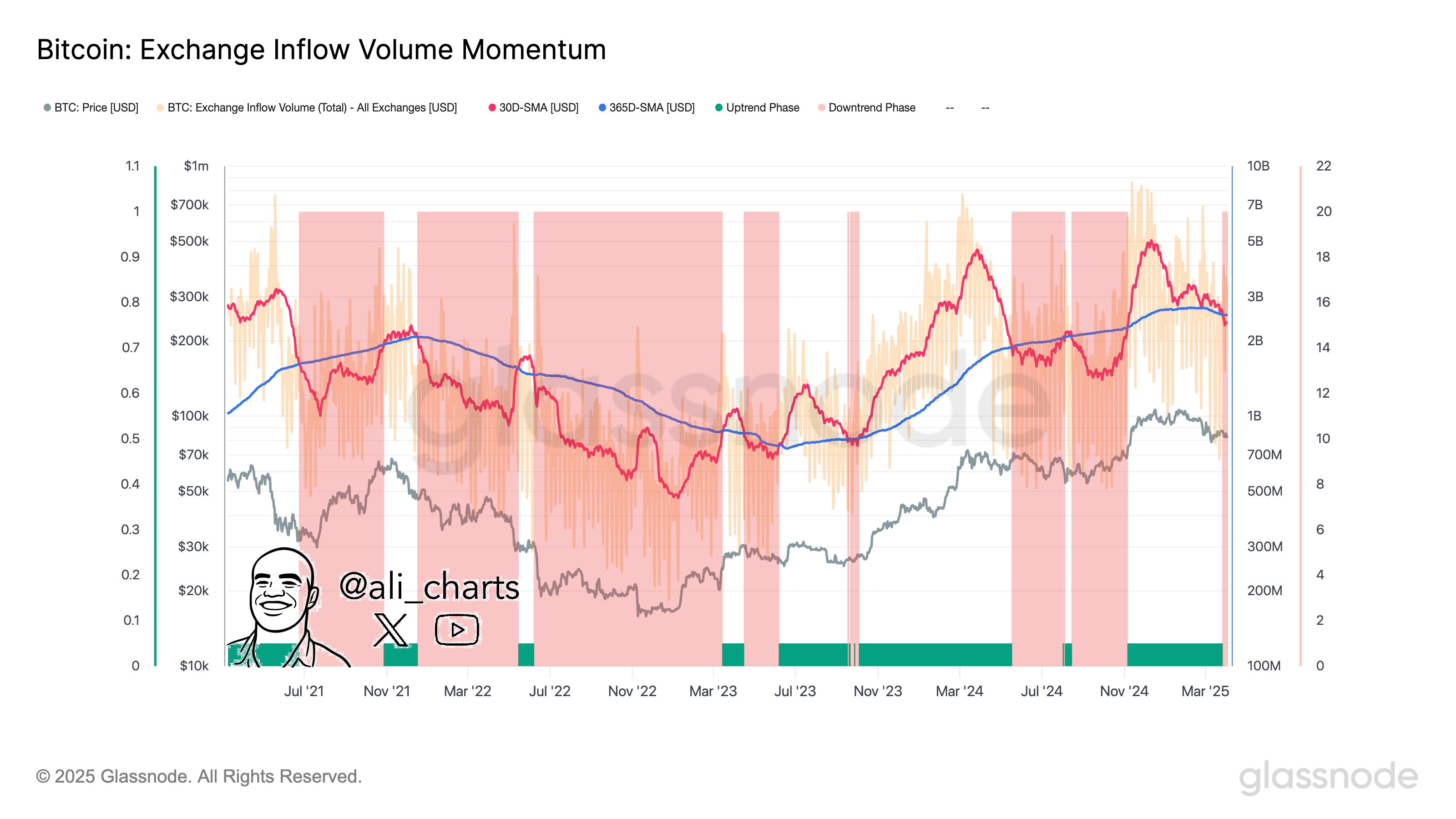

In different information, widespread crypto professional Ali Martinez has reported a decline in Bitcoin exchange-related exercise indicating diminished buyers’ curiosity and community utilization. Notably, this improvement means that buyers are hesitating to deposit or withdraw Bitcoin on exchanges maybe as a consequence of market uncertainty on the asset’s rapid future trajectory.

In response to Martinez, Bitcoin is now prone to endure a pattern shift as buyers watch for the following market catalyst. Notably, Bitcoin has proven commendable resilience regardless of the brand new tariffs imposed by the US authorities on April 2. In response to information from Santiment, BTC’s value dipped solely 4% within the hours following the announcement—a milder response in comparison with earlier tariff-related market strikes.

Since then, BTC has made some value positive aspects and at present trades at $83,805 as buyers flock to the crypto market which has recorded a $5.16 billion influx over the previous day. In the meantime, BTC’s buying and selling quantity is up by 26.52% and is valued at $43.48 billion.

Featured picture from UF Information, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.