Bitcoin has seen a restoration above $99,000 lately, however the development going down within the Open Curiosity may increase issues in regards to the surge’s longevity.

Bitcoin Open Curiosity Has Spiked Alongside The Newest Rally

In a brand new publish on X, CryptoQuant group analyst Maartunn talked in regards to the development within the Bitcoin Open Curiosity alongside the most recent worth rally. The “Open Interest” right here refers to an indicator that retains monitor of the full quantity of positions associated to BTC which are at present open on all derivatives exchanges.

When the worth of this metric rises, it means the derivatives customers are opening recent positions. Usually, the full quantity of leverage goes up within the sector as new positions pop up, so this sort of development can result in greater volatility for the asset’s worth.

However, the indicator’s worth registering a decline implies the holders are both closing up positions of their very own volition or getting liquidated by their platform. The cryptocurrency could act in a extra secure method following such a leverage flushout.

Now, right here is the chart shared by the analyst, that exhibits the development within the Bitcoin Open Curiosity, in addition to its 24-hour proportion change, over the past week:

The worth of the metric seems to have shot up throughout the previous day | Supply: @JA_Maartun on X

From the above graph, it’s seen that the Bitcoin Open Curiosity has seen a speedy improve alongside the most recent restoration rally within the coin’s worth. On the peak, the 24-hour proportion change hit the 7.2% mark, which is kind of important.

Whereas it’s regular for speculative exercise to observe a pointy transfer within the cryptocurrency, an extra of it might nonetheless be an alarming signal. It’s because in a high-leverage setting, the probabilities of a mass liquidation occasion can turn out to be notable.

In principle, the volatility rising out of such derivatives market chaos can take the cryptocurrency in both path, however normally, Open Curiosity spikes that accompany rallies find yourself performing as an impedance for it. Thus, it’s attainable that the most recent Bitcoin rally can also unwind in a unstable method.

The development within the Open Curiosity isn’t the one one that implies volatility could possibly be coming for the asset, because the analytics agency Glassnode has identified in an X publish.

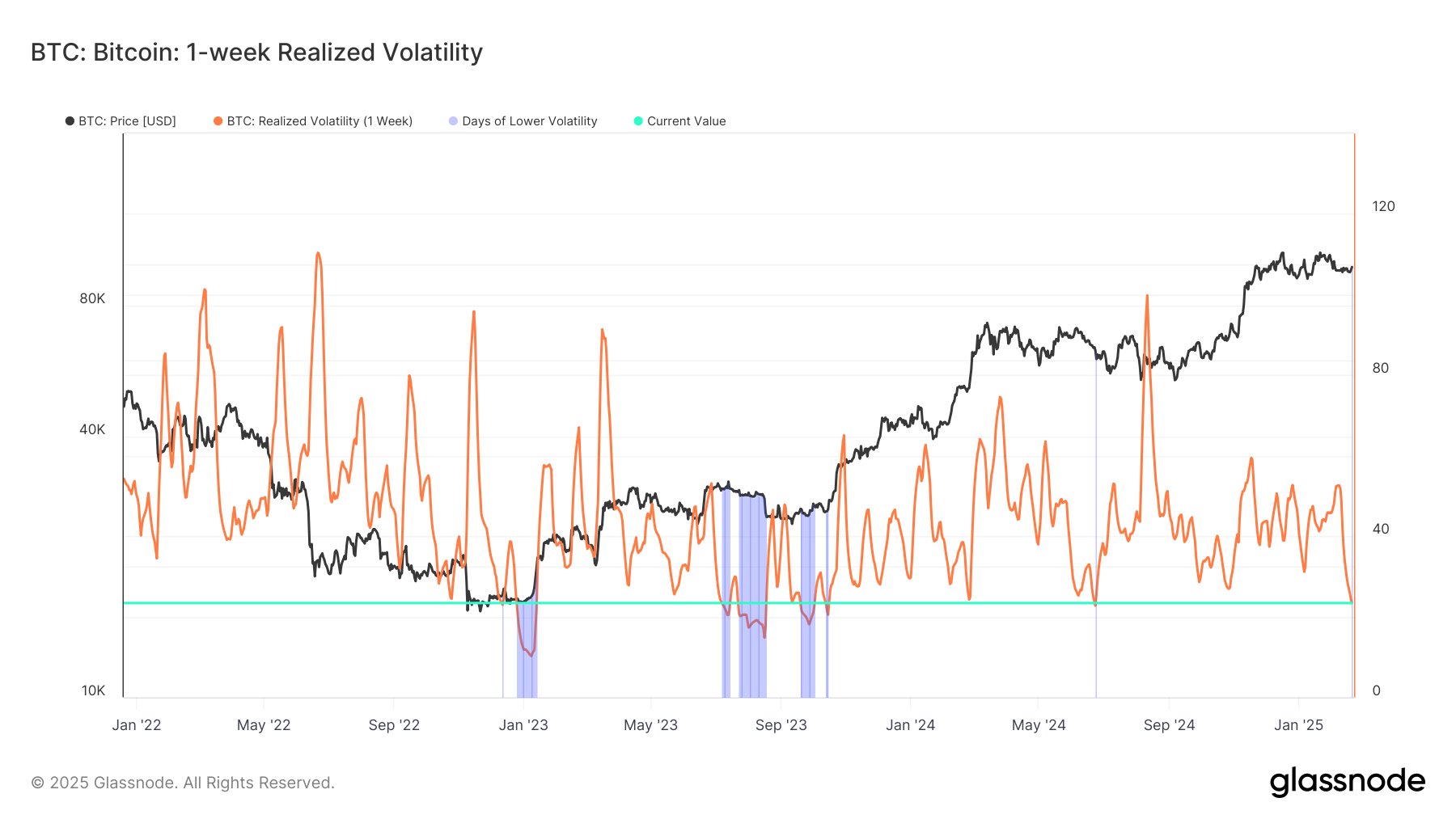

The development within the BTC Realized Volatility over the previous few years | Supply: Glassnode on X

The chart shared by the analytics agency is for the 1-week Realized Volatility, an indicator that tracks the share change between the very best and lowest factors within the Bitcoin worth recorded over the last seven days.

As displayed within the graph, the metric’s worth has plunged lately, implying the asset has been buying and selling inside a really slender vary. “In the past four years, it has dipped lower only a few times – e.g., Oct 2024 (22.88%) & Nov 2023 (21.35%),” explains Glassnode. “Similar compressions in the past led to major market moves.”

BTC Value

Following a bounce of round 2% within the final 24 hours, Bitcoin has recovered again above the $99,300 stage.

Appears like the value of the coin has been marching up in latest days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com