Information exhibits the Bitcoin Concern & Greed Index nonetheless hasn’t achieved an excessive worth. Right here’s what this might imply for BTC’s worth restoration.

Bitcoin Concern & Greed Index Is Sitting At 75 Proper Now

The “Fear & Greed Index” refers to an indicator created by Various that tells us concerning the common sentiment current among the many buyers within the Bitcoin and wider cryptocurrency markets.

This index bases its estimation on the next 5 elements: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Traits. The indicator represents the calculated sentiment as a rating mendacity between zero and hundred.

When the metric has a worth underneath 47, it means the buyers as an entire share a sentiment of worry. Then again, it being over 53 implies the presence of greed available in the market. All values mendacity between these two cutoffs correspond to an general impartial mentality.

Now, right here is how the most recent worth of the Bitcoin Concern & Greed Index appears:

Appears just like the metric is at a worth of 75 in the mean time | Supply: Various

As is seen above, the merchants within the sector at present maintain a sentiment of greed because the index is sitting at 75. This grasping mentality can be fairly sturdy, actually so sturdy that it’s proper on the sting of a particular zone generally known as the intense greed.

Excessive greed happens when the indicator surpasses this 75 stage. There’s a comparable area for the worry facet as properly, referred to as the intense worry. This one happens when the metric falls beneath 25.

The current worth is a notable enchancment as in contrast to a couple days in the past, but it surely’s unchanged from yesterday. That is fascinating because the cryptocurrency has solely continued its restoration run over the previous day.

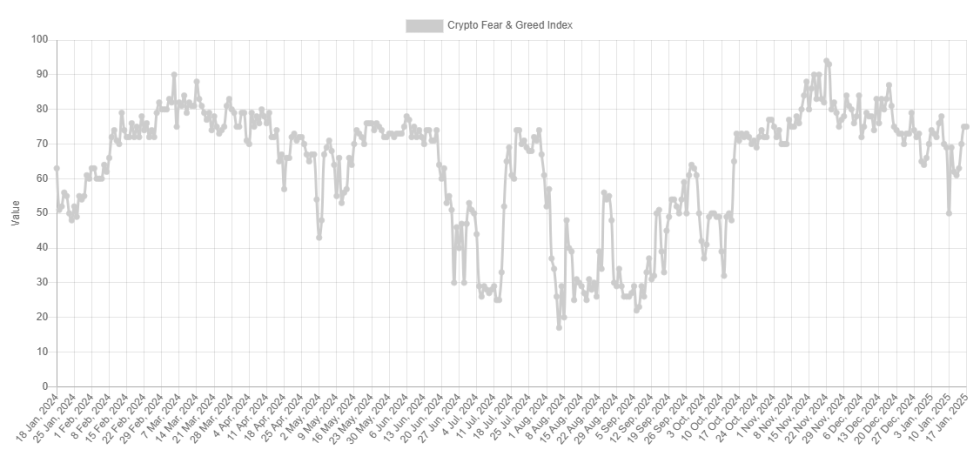

The beneath chart exhibits a report of the values of the Bitcoin Concern & Greed Index over the previous yr.

The indicator seems to have seen an increase in latest days | Supply: Various

Traditionally, Bitcoin has tended to maneuver in a manner that goes opposite to the expectations of the bulk, with the chance of such an reverse transfer solely rising the extra certain the group turns into. Due to this, tops and bottoms within the asset have usually occurred when the index has been within the respective excessive zone.

BTC has furthered its run at present because the indicator’s worth is more likely to be increased tomorrow, however the truth that the coin has been rallying in direction of its all-time excessive whereas the index has been sitting out of the intense greed zone could possibly be a constructive signal for its sustainability.

The value prime final month coincided with the Concern & Greed Index hitting 87, whereas the one in March with 88. It’s doable that the following prime would possibly happen underneath these ranges, however they nonetheless present some reference of when the sentiment begins turning into really heated up.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $104,800, up greater than 11% over the previous week.

The value of the coin is quick charging towards its ATH | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Various.me, chart from TradingView.com