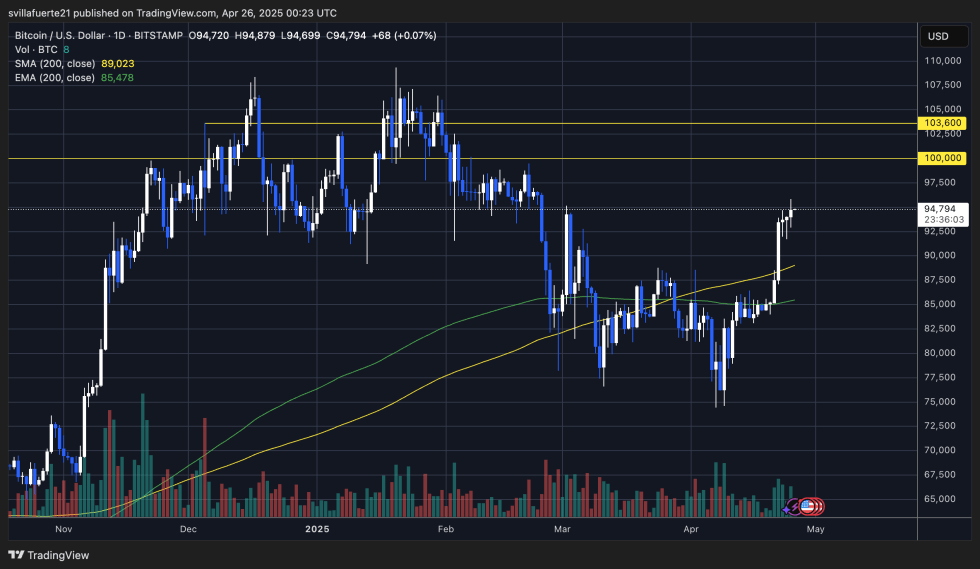

Bitcoin is now buying and selling above the $93,000 stage, displaying robust momentum as bulls proceed to push costs greater. After weeks of uncertainty and heavy volatility, the pattern seems to be shifting towards restoration. The principle goal now’s reclaiming the vital $100,000 mark, which might affirm a sustainable rally into uncharted territory and set the stage for the subsequent main bullish section.

Nonetheless, dangers stay elevated. Tensions between the US and China persist, and the continued commerce battle continues to create an unstable backdrop for international markets. Traders are navigating a fragile atmosphere the place any damaging developments might set off sharp reactions throughout danger property, together with Bitcoin.

High crypto analyst Daan shared a technical evaluation highlighting that BTC is presently experiencing a powerful bounce and continuation from the 0.382 Fibonacci Retracement stage. Traditionally, this Fibonacci zone acts as a basic assist space throughout wholesome uptrends, offering a powerful basis for value continuation if defended efficiently.

Bitcoin Faces Essential Section As Bulls Combat For Increased Floor

Bitcoin is now coming into an important section as value motion over the approaching weeks might outline the short-term and even medium-term pattern. After reclaiming the $93,000 stage, bulls have regained short-term management. Nonetheless, buyers stay cautious, figuring out that any main damaging catalyst might rapidly reverse momentum throughout danger property, together with Bitcoin.

Analysts are break up on the subsequent large transfer. Some consider Bitcoin might rally above its all-time highs (ATH) within the coming weeks, pushed by rising institutional flows and a shift in danger urge for food. Others warning that the macroeconomic backdrop stays too fragile, warning that we’ve not but seen the complete extent of draw back dangers.

Daan’s optimistic view highlights that Bitcoin’s present pattern construction is way extra mature than in earlier cycles. He notes that whereas the pattern has develop into steadier and slower, it’s also extra dependable, providing fewer excessive swings and higher long-term positioning for buyers.

Daan factors to the current robust bounce and continuation from the 0.382 Fibonacci Retracement stage as affirmation of this maturity. Traditionally, holding this key Fibonacci zone in an uptrend indicators robust underlying demand and market resilience.

The approaching days will likely be vital for Bitcoin to take care of momentum and push above the $95,000–$96,000 resistance vary to proceed towards uncharted territory.

Technical Particulars: Key Indicator Hovers Round $89K

Bitcoin is buying and selling at $94,700 after briefly pushing above the $95,800 mark earlier immediately. Bulls proceed to point out power, however the actual take a look at stays the psychological $100,000 stage. Breaking and sustaining above $100K would affirm a serious rally into new all-time highs (ATH) and sure spark one other wave of bullish momentum throughout the market.

Nonetheless, a number of analysts warning {that a} wholesome retrace from present ranges continues to be potential earlier than Bitcoin could make a critical push into six figures. After a powerful multi-week rally, some profit-taking and cooling off can be pure, serving to to reset funding charges and sentiment earlier than the subsequent main leg greater.

The important thing stage to observe on the draw back is $89,000. The 200-day transferring common (MA), an important pattern indicator, presently lies round that zone. So long as Bitcoin holds above the 200-day MA, the broader uptrend stays intact, and any pullbacks would doubtless be considered as shopping for alternatives by buyers.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.