Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

In accordance with a CryptoQuant Quicktake put up printed earlier at present, Bitcoin (BTC) could not have reached the height of the present market cycle simply but. A key on-chain metric means that there may very well be one ultimate leg up for the main cryptocurrency earlier than this bull market concludes.

Bitcoin To Hit New Peak Quickly?

Knowledge from CoinGecko exhibits that Bitcoin has dropped greater than 23% since reaching its most up-to-date all-time excessive (ATH) of $108,786, on January 8. The highest digital asset has largely been affected by ongoing world macroeconomic uncertainties, notably these associated to US President Donald Trump’s new tariff insurance policies.

Associated Studying

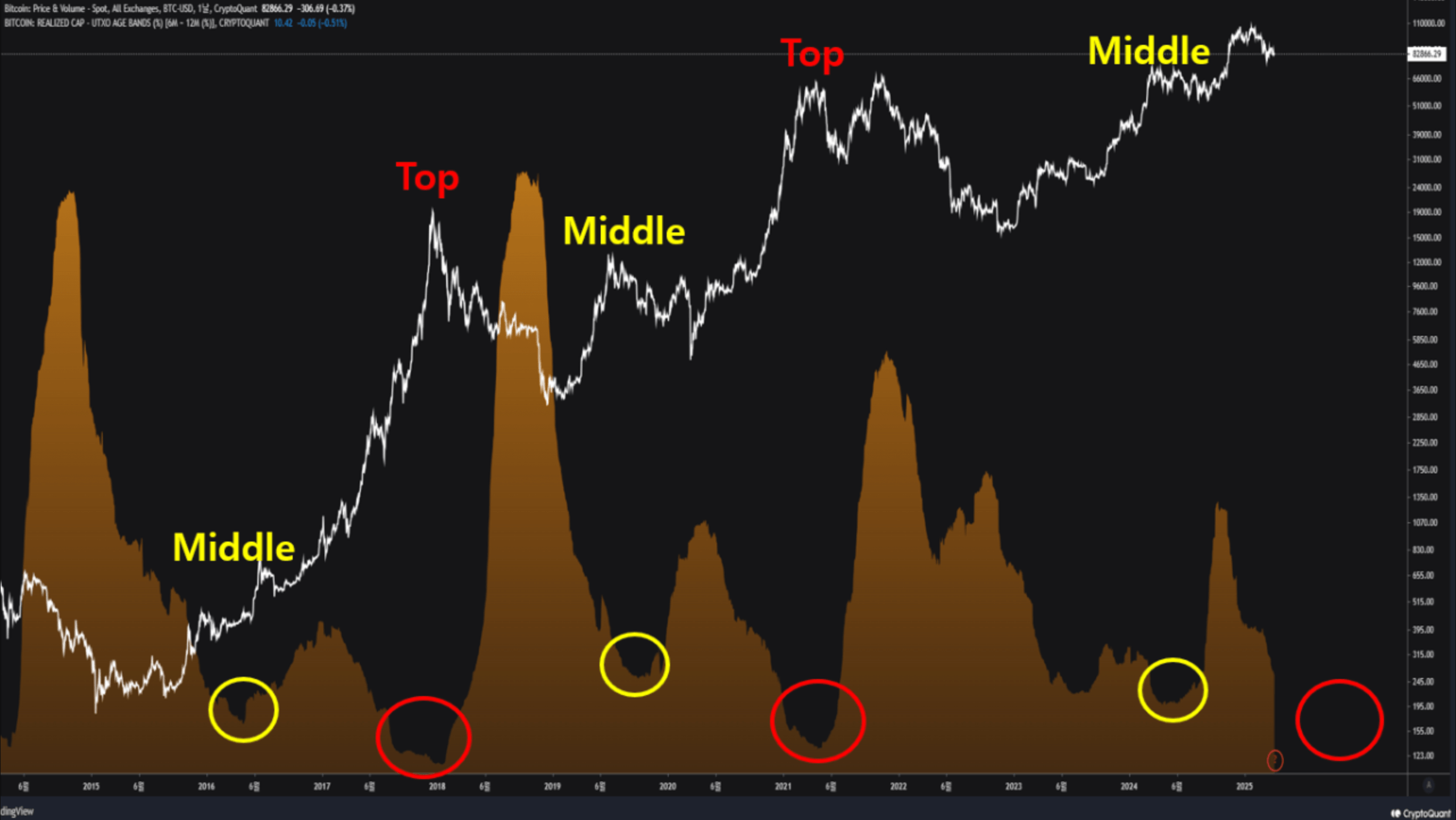

Regardless of the pullback, CryptoQuant contributor Crypto Dan believes Bitcoin should have room to run. In a current Quicktake put up, he pointed to the ratio of BTC quantity traded over a six to 12-month interval as a vital indicator of the present market cycle’s development.

This ratio displays the quantity of recent capital coming into the crypto market through the cycle and has traditionally been tightly correlated with market actions. In accordance with Crypto Dan:

Sometimes, this ratio first declines, signalling the top of the early part of the bull cycle. After a while, it declines once more, reaching a decrease stage than the primary drop, marking the top of the bull cycle.

Following the primary decline within the ratio, the market usually regains bullish momentum. Subsequently, the second leg of the rally tends to draw latecomers and retail traders whose participation sends BTC to new highs.

Finally, as market euphoria begins to peak and distribution part begins, the amount ratio experiences a second, sharper decline. Finally, the second drop within the ratio marks the top of the bull cycle and precedes a major market correction.

In accordance with the next chart, BTC hit a crucial midpoint in March 2024, when the six to 12-month quantity ratio skilled its first notable decline – per patterns noticed in earlier cycles. The ratio now seems to be coming into its second and ultimate dip, probably main Bitcoin towards this cycle’s final peak.

BTC Holders Seeing Present Pullback As Short-term

A number of indicators counsel that Bitcoin holders see the continued market correction as short-term. For instance, current evaluation by CryptoQuant contributor Onchained revealed that short-term BTC holders are persevering with to carry their cash regardless of being in a loss – probably in anticipation of an upcoming bullish reversal.

Associated Studying

Moreover, alternate internet circulate information factors towards a possible worth rally, indicating lowered promoting strain. At press time, BTC is buying and selling at $82,086, down 1.5% within the final 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com