Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

After an eventful begin to the week marked by a pointy downward swing beneath $100,000, the Bitcoin value has recovered excellently, returning above the $107,000 mark to shut the week. Despite Bitcoin’s latest restoration, there appears to be a distinct sentiment out there which, apparently, has been rising over time. Right here’s how the present rising sentiment may have an effect on the premier cryptocurrency’s future trajectory.

Quick Positions Surge Over The Previous 7 Days — What This Means

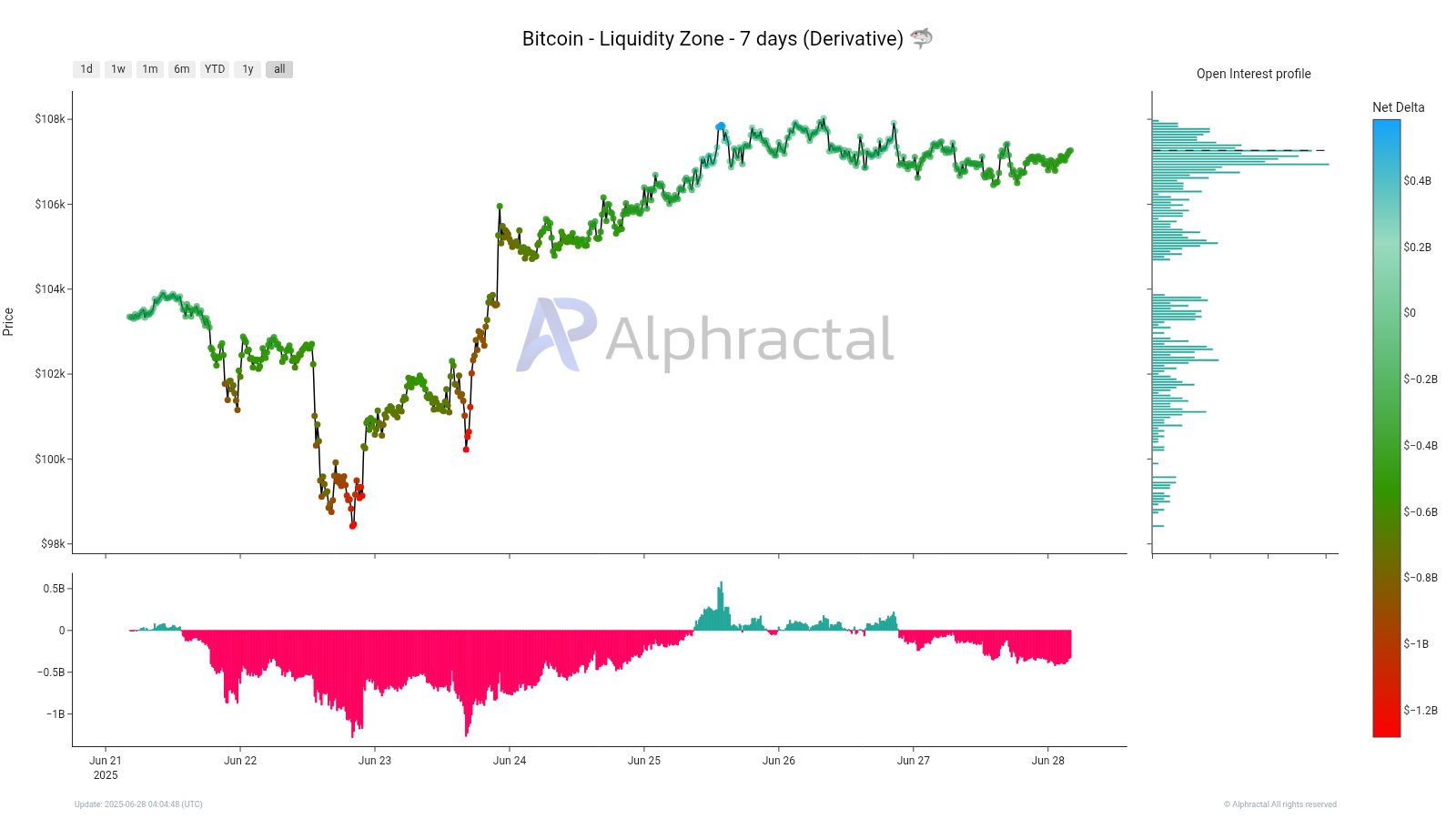

In a June twenty eighth submit on social media platform X, cryptocurrency analytics agency Alphractal shared an attention-grabbing on-chain improvement within the Bitcoin market.

Associated Studying

This on-chain statement relies on the Liquidity Zone (7 Days) indicator, which measures three necessary information: on one hand, it’s used to watch the worth motion of Bitcoin; on one other, the Internet Delta of open curiosity or positions; and, lastly, it reveals the distribution of open curiosity at varied value ranges.

For a bit of context, the open curiosity Internet Delta measures the distinction between lengthy and quick open positions out there. If the Internet Delta reads constructive, it means the consumers populate the market extra. However, a detrimental studying means there are extra quick positions open than longs.

Within the submit on X, Alphractal identified that, over the span of seven days, extra positions have been opened in a wager towards the worth of BTC. From the chart beneath, the crimson bars characterize a detrimental Internet Delta. As has been previously defined, what this implies is that the quick merchants at the moment dominate the market.

Apparently, the shorts-dominated market doesn’t precisely assure that we’ll expertise a sell-off within the close to future. It’s because the excessive detrimental Internet Delta was recorded at a time when Bitcoin’s value remains to be at a steady stage, even with little progress.

When promote positions are opened in a steady however bullish market, this often signifies that the bears is likely to be getting trapped. If, finally, the Bitcoin value overcomes the promote resistance, a phenomenon referred to as a brief squeeze will happen.

On this situation, sellers will likely be compelled to purchase again at greater costs, thereby pushing the Bitcoin value to the upside. This upward momentum will then additional liquidate quick positions.

What’s Subsequent For Bitcoin?

There are uncertainties as as to whether the Bitcoin market may break the promote resistance, or go in favour of the sellers. For that reason, Alphractal warns that these with bearish sentiment must be cautious about their subsequent transfer.

Associated Studying

As of this writing, Bitcoin appears caught inside a uneven vary over the previous day and is at the moment valued at $107,309. The flagship cryptocurrency’s measly progress of 0.2% up to now 24 hours pales compared to its seven-day rise of 5.2%.

Featured picture from IStock, chart from TradingView