OKX buying and selling bots provide an environment friendly method for merchants to automate crypto buying and selling utilizing AI-powered methods. These bots are designed to execute trades primarily based on predefined parameters, serving to merchants handle dangers and capitalize on market actions.

As AI buying and selling turns into extra well-liked within the crypto area, OKX is stepping up its recreation by providing numerous buying and selling bots and the choice for customers to create their very own in a number of easy steps.

What Are OKX Trading Bots?

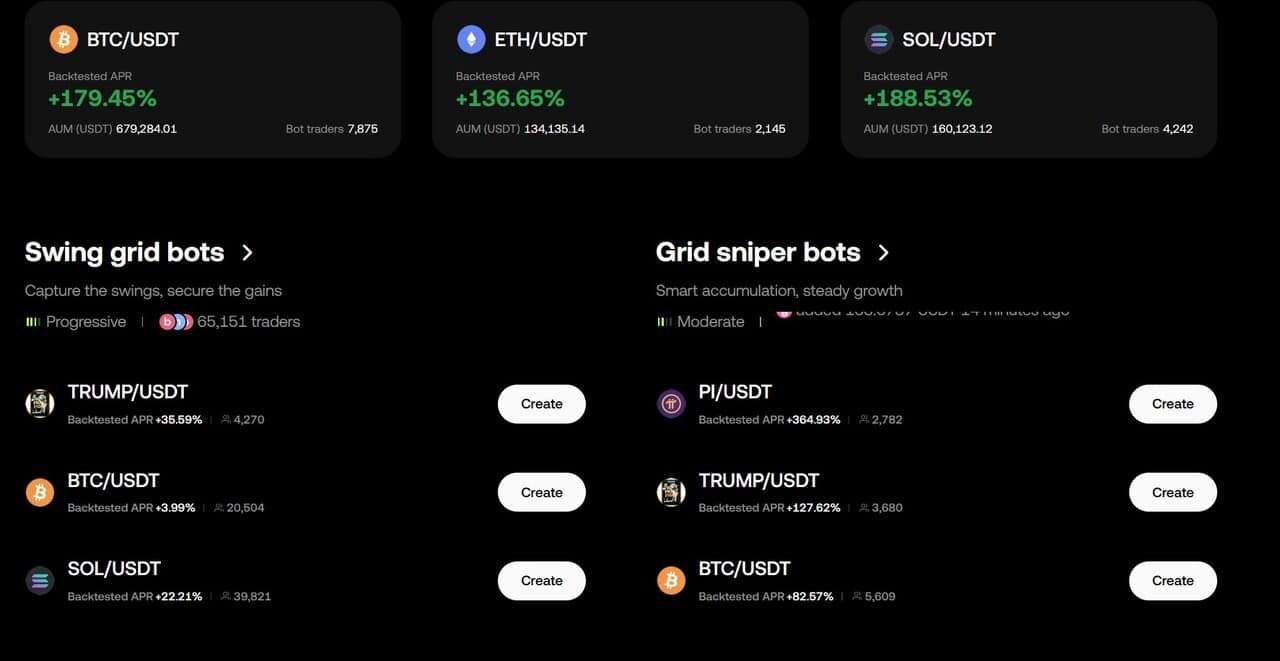

OKX buying and selling bots use AI-powered automation to execute trades primarily based on predefined methods like spot DCA, swing grid, and grid sniper methods. Customers can tweak particular parameters to pick an present bot, or create their very own bot parameters.

These bots monitor market traits and place orders with out requiring guide intervention. By leveraging these clever algorithms, merchants can profit from market alternatives across the clock, even once they’re not on-line to execute guide trades.

One main good thing about utilizing OKX buying and selling bots is their means to execute trades with distinctive pace and effectivity, eliminating the delays typically related to guide buying and selling. Moreover, these bots take away emotional decision-making from the equation and guarantee a disciplined strategy to buying and selling.

One other benefit is their means to take part available in the market 24/7, repeatedly analyzing information and executing trades even when the consumer is just not actively monitoring the market.

Essential Options of OKX Trading Bots

There are a number of causes to decide on OKX buying and selling bots over different buying and selling options. First, utilizing these bots is totally free for OKX customers. Moreover, there are extra advantages to contemplate, together with their AI-powered algorithms and a number of technique choices.

AI-Powered Sensible Trading

OKX integrates AI and machine studying to reinforce buying and selling effectivity. The AI bots analyze market traits and historic information to optimize commerce execution, making real-time changes to maximise potential income whereas minimizing dangers.

A number of Technique Choices

OKX presents numerous buying and selling methods tailor-made to completely different market circumstances. Listed here are all bots provided by OKX:

- Spot grid

- Futures grid

- Futures DCA (Martingale)

- Sensible arbitrage

- Spot DCA (Martingale)

- Recurring purchase

- Sign bot

- Iceberg orders

- TWAP (Time-Weighted Common Value) orders

- Infinity grid

- Sensible portfolio

- Arbitrage

For instance, grid buying and selling is designed to capitalize on market fluctuations by inserting purchase and promote orders inside a predefined worth vary.

The arbitrage technique generates income by exploiting worth variations throughout markets. The Greenback-Price Averaging (DCA) technique permits traders to allocate fastened quantities at common intervals, serving to mitigate the influence of market volatility.

Futures bots allow merchants to automate leveraged trades within the futures market, enhancing alternatives for revenue in each rising and falling markets.

Customization & Threat Administration

Merchants can customise their bot settings primarily based on danger tolerance and buying and selling targets. This consists of setting stop-loss and take-profit ranges to handle danger successfully, defining entry factors to optimize commerce execution, and adjusting numerous technique parameters to make sure adaptability to market circumstances.

Actual-Time Market Adaptation

OKX buying and selling bots repeatedly monitor market actions and regulate their methods accordingly. This adaptability ensures that trades are executed in response to altering circumstances, bettering general efficiency and decreasing the probability of losses resulting from sudden market shifts.

Easy methods to Use OKX Trading Bots

Utilizing OKX buying and selling bots is easy. Right here’s how you can do it:

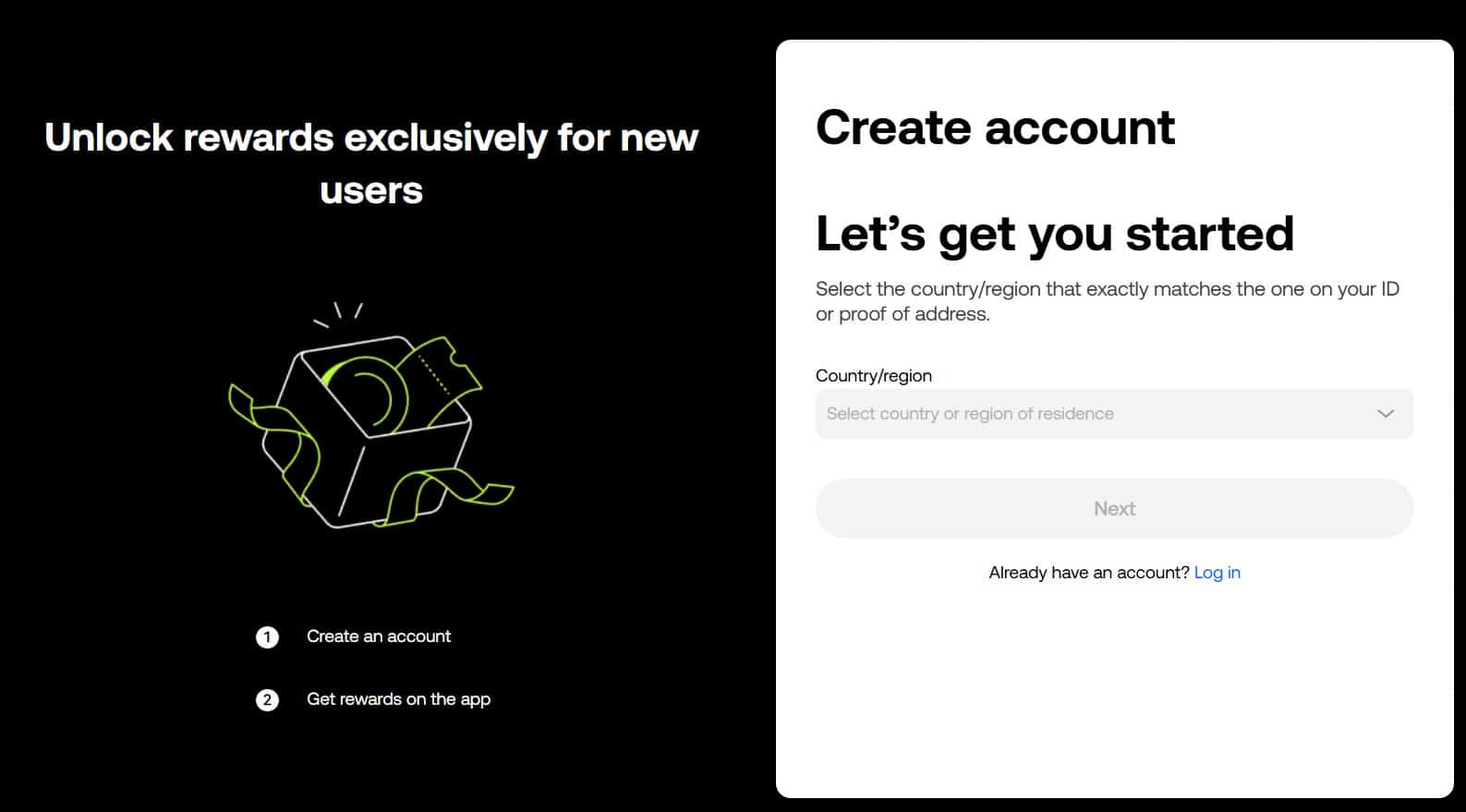

Step 1: Go to OKX and choose your nation of residence to enroll.

Step 2: Activate your electronic mail utilizing the verification code and confirm your cellphone quantity.

Step 3: Use a singular and robust password and choose “Next”.

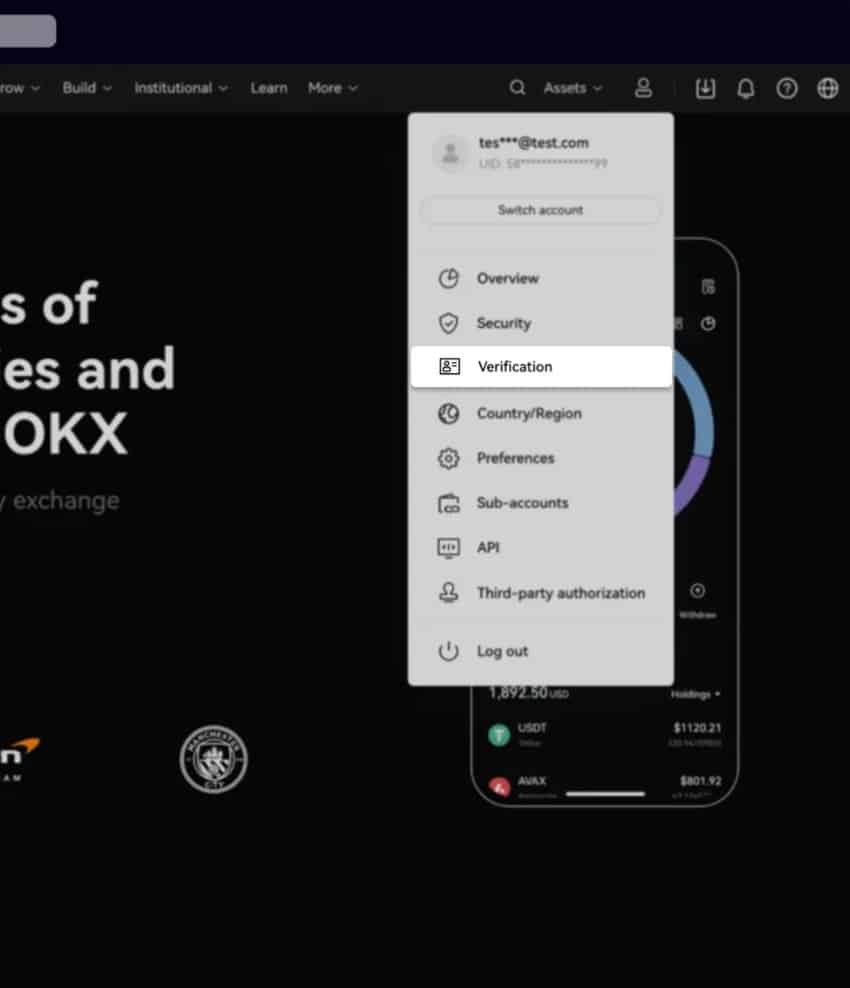

Step 4: Log in to your account and confirm your ID.

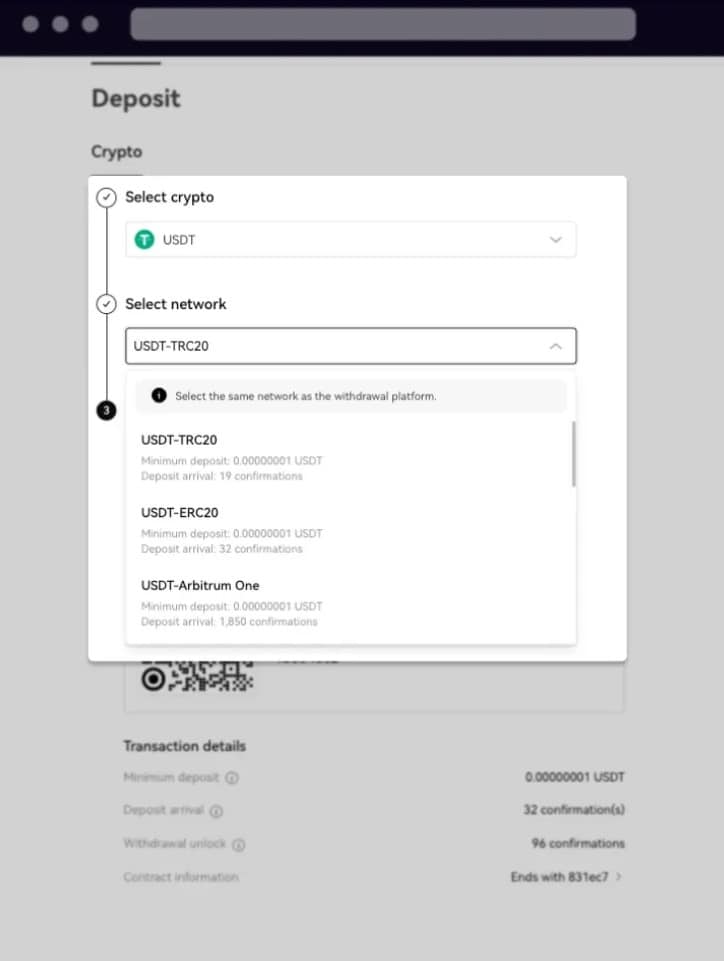

Step 5: Log in upon getting arrange your account and deposit funds through the “Assets” part.

Step 6: Choose the crypto and community you wish to deposit.

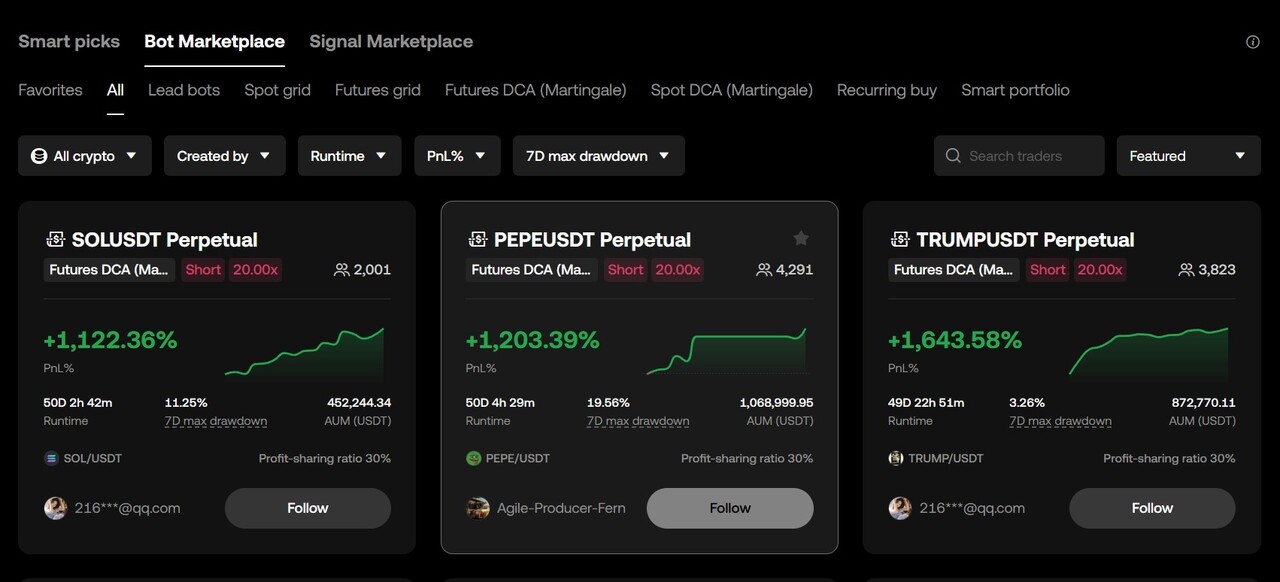

Step 7: As soon as your deposit lands, hover over the “Trade” part on the prime and choose “Trading bots.

Step 8: Search for the bots you wish to use, together with bullish or bearish bots, grid bots, DCA bots, and extra.

Step 9: Choose the bot you need and customise the parameters. Replace cease loss, take revenue, and the quantity you want to use.

Go to OKX

Why OKX Is the Go-To Selection for Automated Trading

OKX is a most popular platform for automated buying and selling resulting from its aggressive buying and selling charges of 0.08% (maker) and 0.10% (taker) for the spot market, which guarantee cost-effective transactions, and the number of bots it presents.

The platform additionally presents deep liquidity, permitting clean commerce execution with out important worth slippage. Safety is one other main benefit, as OKX employs sturdy measures to guard consumer funds and information.

Moreover, the seamless integration of buying and selling bots inside the OKX ecosystem ensures a hassle-free expertise for customers trying to automate their trades effectively.

Evaluating OKX Trading Bots to Different Crypto Bots

OKX buying and selling bots stand out resulting from their AI-powered methods, various buying and selling choices, and sturdy danger administration options. Beneath is a comparability of OKX with different main automated buying and selling platforms:

| Characteristic | OKX | Binance | Pionex | KuCoin |

|---|---|---|---|---|

| Bot Sorts | Grid (Spot/Futures), DCA, Arbitrage, Sign Bot, Infinity Grid, and extra | Spot Grid, Futures Grid, Arbitrage, Rebalancing, Futures TWAP, and extra | Grid, Infinity Grid, Martingale, Reverse Grid, DCA, Arbitrage, and extra | Spot Grid, Futures Grid, DCA, Martingale, Sensible Rebalance, Infinity Grid |

| Customization | Excessive (Bot Market, customized bots) | Reasonable (pre-set methods) | Excessive (A number of bots, PionexGPT) | Reasonable (AI-driven changes) |

| Spot Trading Charges | 0.08% maker / 0.10% taker | 0.10% maker / 0.10% taker | 0.05% maker / 0.05% taker | 0.10% maker / 0.10% taker |

| Futures Trading Charges | 0.02% maker / 0.05% taker | 0.02% maker / 0.05% taker | 0.02% maker / 0.05% taker | 0.02% maker / 0.06% taker |

| Bot Price | Free (solely buying and selling charges) | Free (solely buying and selling charges) | Free (solely buying and selling charges) | Free (solely buying and selling charges) |

| Consumer Interface | Glossy, intuitive, Web3-focused | Accessible, barely cluttered | Minimalist, bot-focused | Clear, beginner-friendly |

| Distinctive Promoting Level | Bot Market, AI-powered bots | Ecosystem depth, liquidity | 16 free bots, PionexGPT | AI-driven dynamic methods |

| Finest For | Versatile merchants, Web3 fanatics | Newcomers, high-volume merchants | Automation fanatics | Newcomers, AI technique customers |

Backside Line – Is OKX Value it?

OKX buying and selling bots present an environment friendly and user-friendly resolution for automating crypto trades. By integrating AI-driven methods, providing a number of buying and selling choices, and prioritizing safety, OKX stands out as a wonderful alternative for merchants in search of to optimize their buying and selling expertise.

Join on OKX at the moment and begin automating your trades with AI-powered methods!

Go to OKX

The publish Automate Your Crypto Trading With OKX Trading Bots appeared first on 99Bitcoins.