After a risky begin to 2025, Bitcoin has now reclaimed the $100,000 mark, setting a brand new all-time excessive and injecting renewed confidence into the market. However as costs soar, a important query arises: are a few of Bitcoin’s most skilled and profitable holders, the long-term traders, beginning to promote? On this piece, we’ll analyze what on-chain knowledge reveals about long-term holder conduct and whether or not current profit-taking ought to be a trigger for concern, or just a wholesome a part of Bitcoin’s market cycle.

Indicators Of Revenue-Taking Seem

The Spent Output Revenue Ratio (SOPR) gives rapid perception into realized revenue throughout the community. Zooming in on current weeks, we will observe a transparent uptick in revenue realization. Clusters of inexperienced bars point out {that a} noticeable variety of traders are certainly promoting BTC for revenue, particularly following the value rally from the $74,000–$75,000 vary to new highs above $100,000.

Nevertheless, whereas this would possibly increase short-term considerations about potential overhead resistance, it’s essential to border this within the broader on-chain context. This isn’t uncommon conduct in bull markets and doesn’t, by itself, sign a cycle peak.

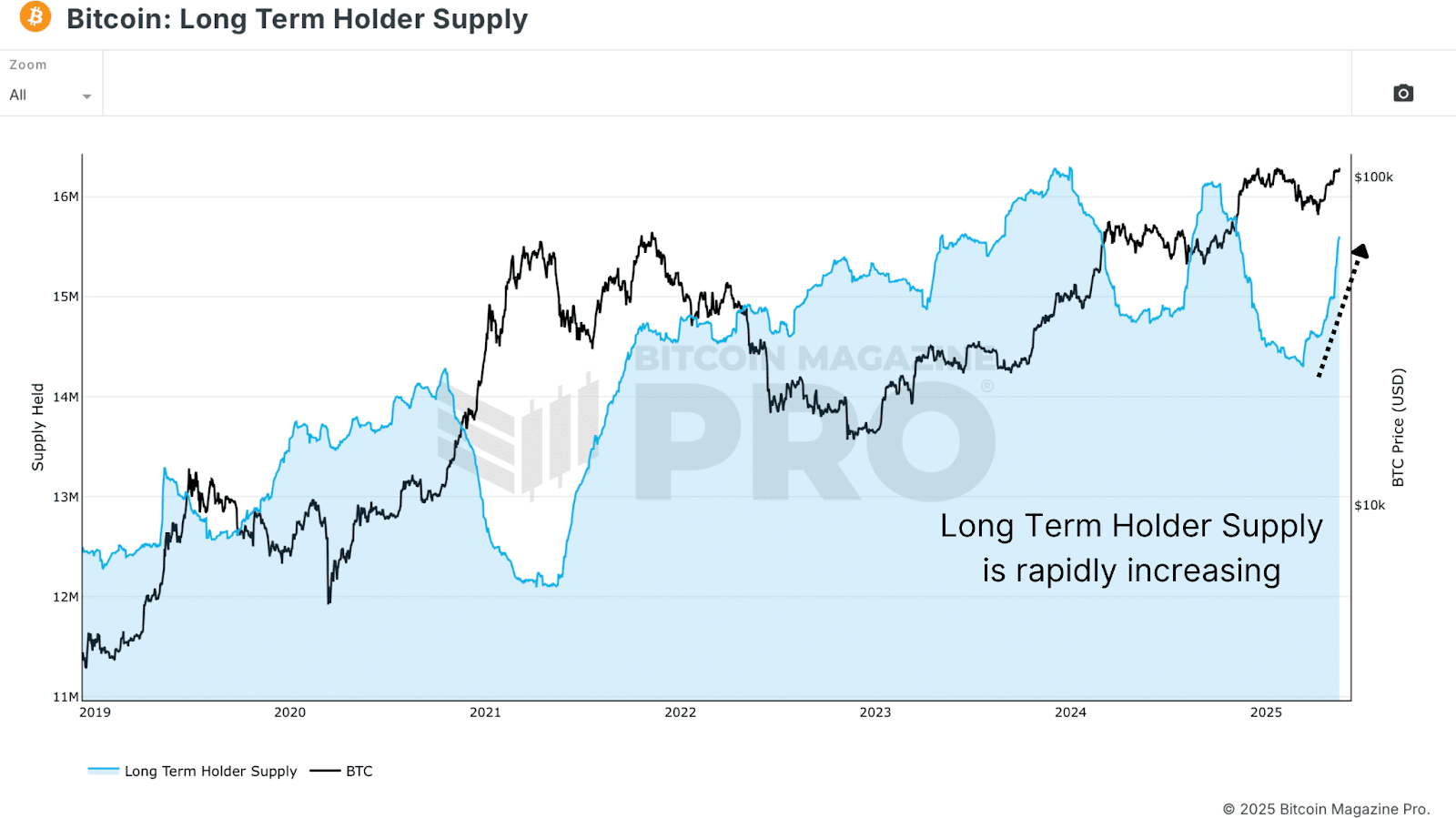

Long-Term Holder Provide Is Nonetheless Rising

The Long-Term Holder Provide, the full quantity of Bitcoin held by addresses for at the very least 155 days, continues to climb, at the same time as costs surge. This metric doesn’t essentially imply recent accumulation is happening now, however reasonably that cash are getting old into long-term standing with out being moved or offered.

In different phrases, many traders who purchased in late 2024 or early 2025 are holding robust, transitioning into long-term holders. This can be a wholesome dynamic typical of the sooner to mid-stages of bull markets, and never but indicative of widespread distribution.

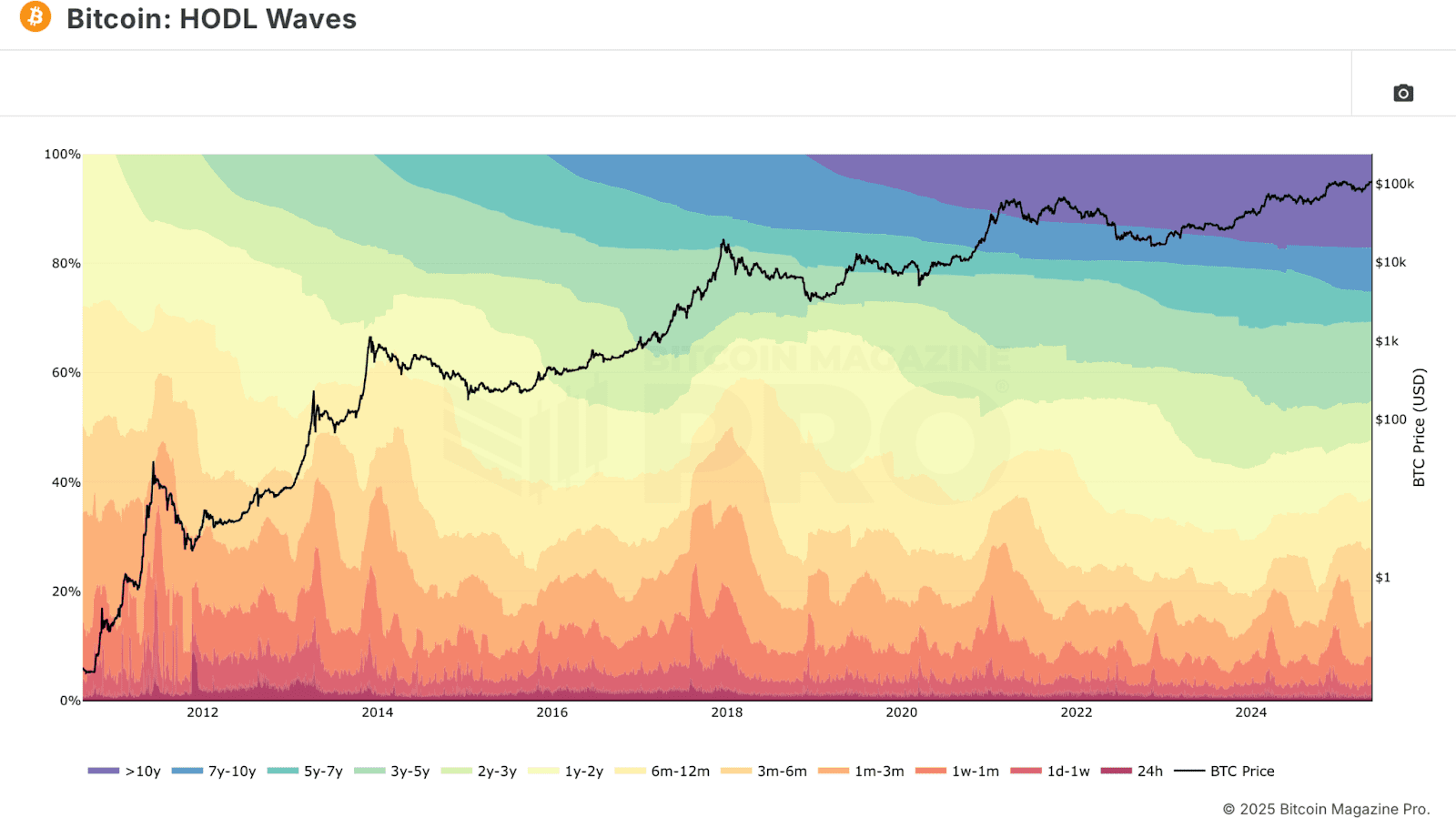

HODL Waves Evaluation

To dig deeper, we use HODL Waves knowledge, which breaks down BTC holdings by pockets age bands. When isolating wallets holding BTC for six months or extra, we discover that over 70% of the Bitcoin provide is at the moment held by mid to long-term contributors.

Curiously, whereas this quantity stays excessive, it has began to lower barely, indicating {that a} portion of long-term holders could also be promoting even because the long-term holder provide will increase. The first driver of the long-term holder provide development seems to be short-term holders getting old into the 155+ day bracket, not recent accumulation or large-scale shopping for.

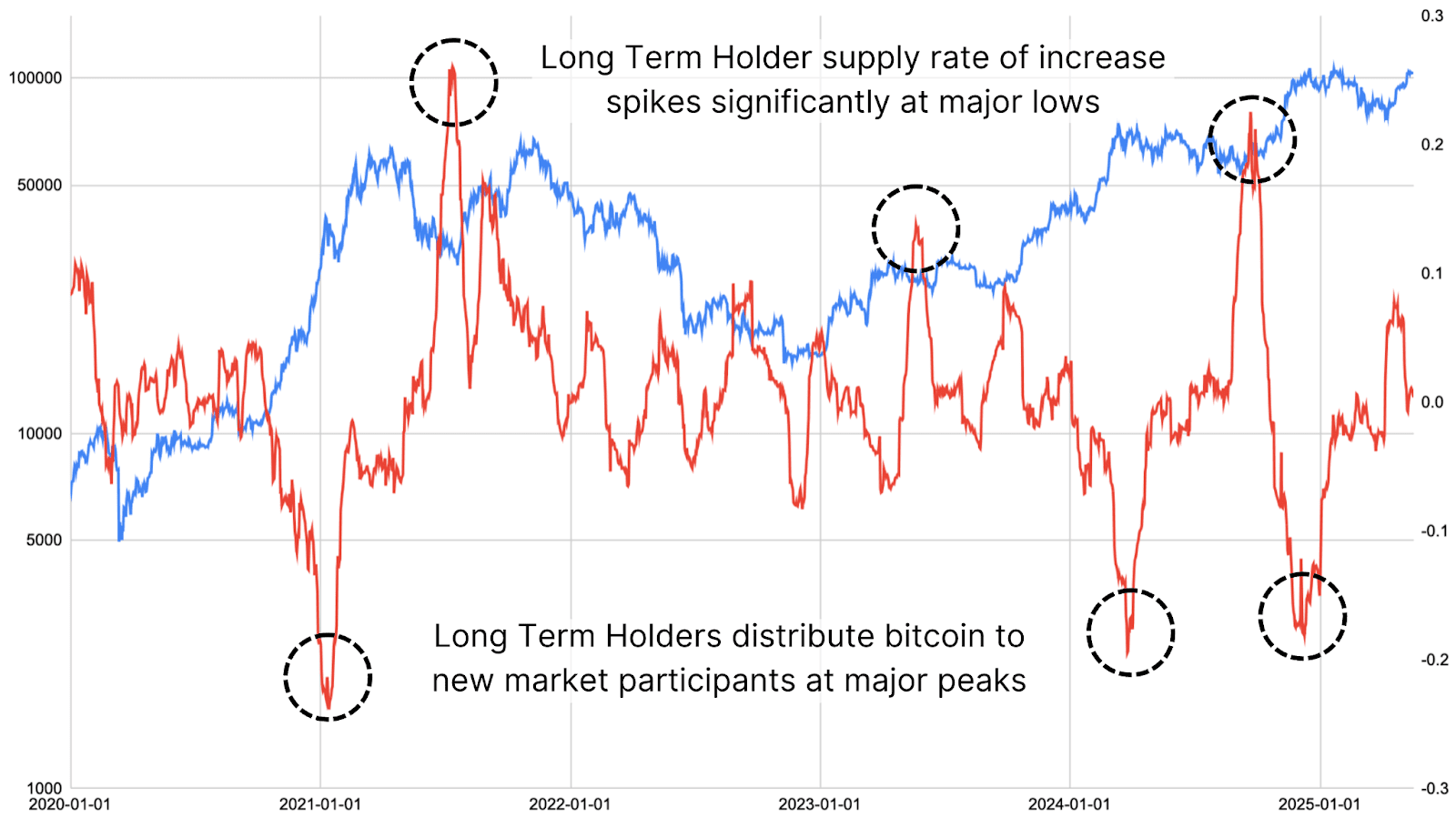

Utilizing uncooked Bitcoin Journal Professional API knowledge, we examined the speed of change in long-term holder balances, categorized by pockets age. When this metric traits downward considerably, it has traditionally coincided with cycle peaks. Conversely, when it spikes upward, it has usually marked market bottoms and intervals of deep accumulation.

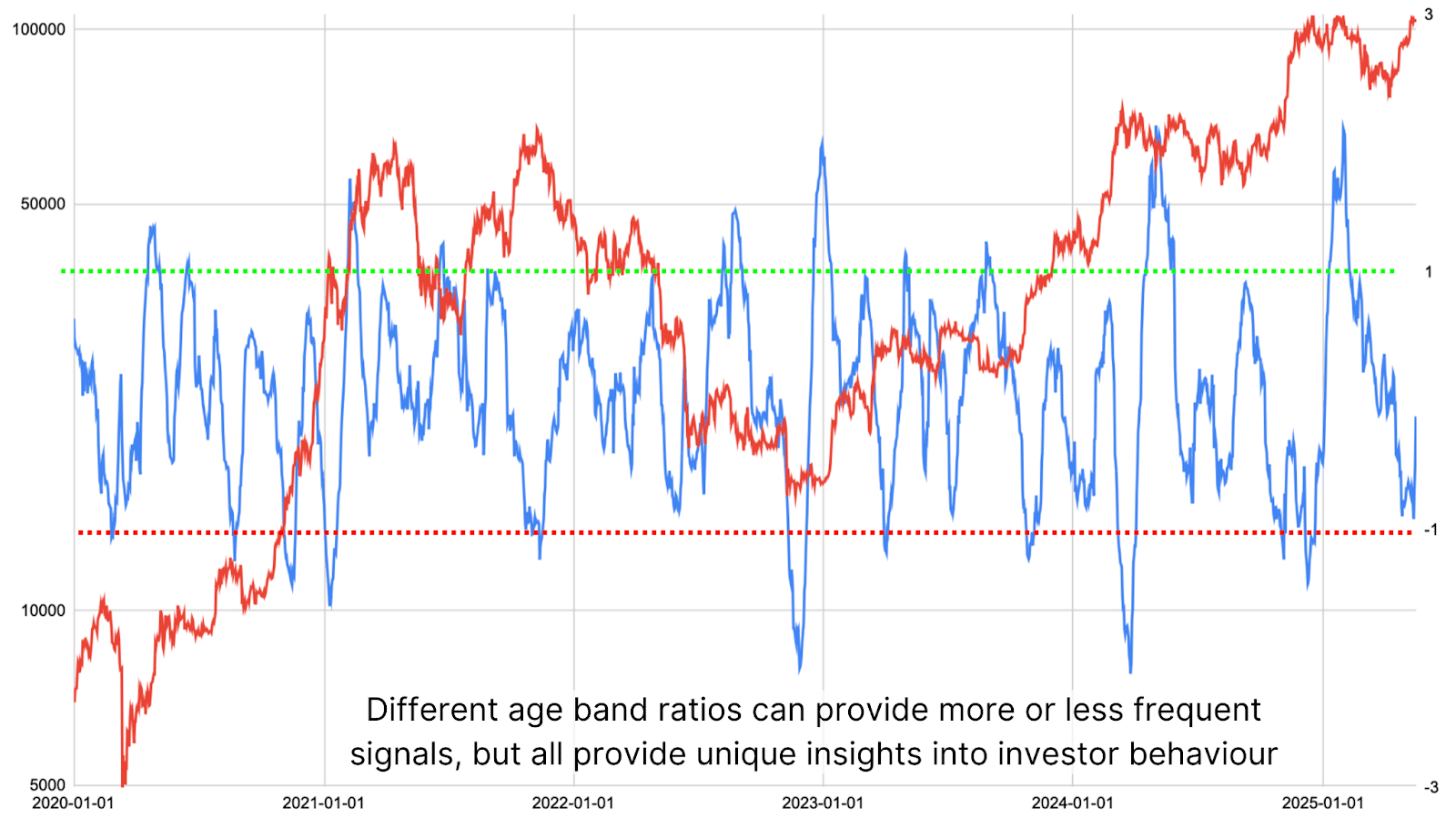

Quick-Term Shifts And Distribution Ratios

To improve the accuracy of those alerts, the info could be sliced extra exactly by evaluating very current entrants (0–1 month holders) towards these holding BTC for 1–5 years. This age band comparability gives extra frequent and real-time insights into distribution patterns.

Determine 5: An age band holder distribution ratio gives worthwhile market insights.

We discover that sharp drops within the ratio of 1–5 yr holders relative to newer contributors have traditionally aligned with Bitcoin tops, in the meantime, fast will increase within the ratio sign that extra BTC is flowing into the arms of seasoned traders is usually a precursor to main worth rallies.

In the end, monitoring long-term investor conduct is among the handiest methods to gauge market sentiment and the sustainability of worth actions. Long-term holders traditionally outperform short-term merchants by shopping for throughout worry and holding via volatility. By analyzing the age-based distribution of BTC holdings, we will achieve a clearer view of potential tops and bottoms out there, with out relying solely on worth motion or short-term sentiment.

Conclusion

Because it stands, there’s solely a minor degree of distribution amongst long-term holders, nowhere close to the size that traditionally alerts cycle tops. Revenue-taking is happening, sure, however at a tempo that seems totally sustainable and typical of a wholesome market atmosphere. Given the present stage of the bull cycle and the positioning of institutional and retail contributors, the info suggests we’re nonetheless inside a structurally robust part, with room for additional worth development as new capital flows in.

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to a rising group of analysts, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding choices.