Este artículo también está disponible en español.

Ethereum has skilled a large drop, shedding over 27% of its worth in lower than 5 days because the market faces excessive concern and uncertainty. The fast sell-off has fueled hypothesis {that a} bear market may very well be on the horizon, with many analysts calling for additional draw back within the coming months.

Associated Studying

Nevertheless, regardless of the overwhelming bearish sentiment, there may be nonetheless an opportunity for Ethereum to recuperate as the value is now testing an important demand degree. If bulls handle to carry this space, ETH may stage a robust rebound and shift momentum again in favor of patrons.

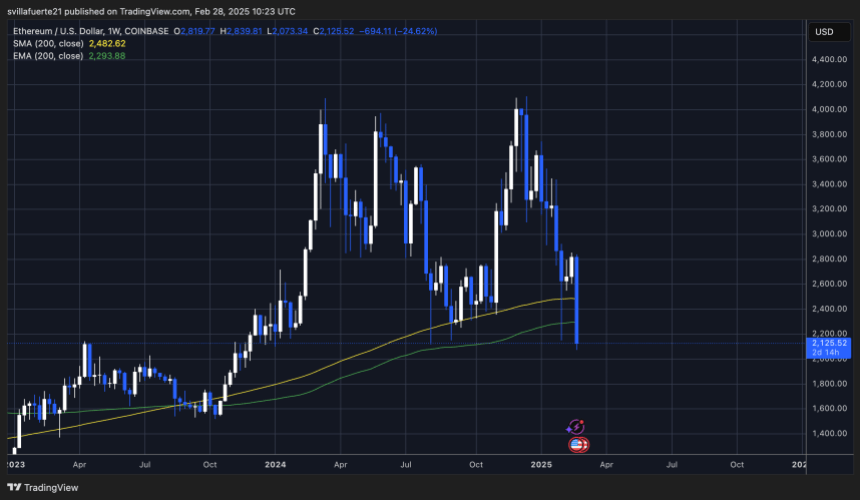

Top analyst BigCheds shared a technical evaluation on X, noting that ETH is reapproaching a vital month-to-month demand degree, which may outline Ethereum’s subsequent main transfer. Traditionally, worth reactions at this degree have led to both a robust bounce or additional capitulation, making the present market circumstances a pivotal second for Ethereum’s long-term trajectory.

The subsequent few days might be essential as Ethereum makes an attempt to stabilize and reclaim key worth ranges. If patrons step in aggressively, ETH may begin a restoration rally, however failure to carry help could result in additional draw back dangers.

Ethereum Struggles Beneath $2,200

Ethereum is buying and selling under $2,200, struggling to regain momentum after a extreme market-wide correction. The altcoin sector continues to bleed, and ETH has now misplaced almost 50% of its worth since peaking at $4,100 in mid-December. Bulls face a vital take a look at as they have to defend key demand ranges to forestall additional promoting strain and entice sturdy shopping for curiosity.

Associated Studying

The state of affairs is extremely risky, with market sentiment shifting towards excessive concern. Buyers fear that Ethereum may proceed its decline if bulls fail to carry help and provoke a significant restoration. Many analysts stay cautious, warning that ETH may enter a protracted consolidation part if it fails to regain misplaced floor.

BigChed’s insights on X spotlight that Ethereum is now re-approaching a key high-timeframe demand zone of round $2,000. Based on Cheds, this can be a must-hold degree—shedding this zone may set off a deeper correction, whereas a robust protection may pave the way in which for a possible restoration rally.

The subsequent few days might be essential for Ethereum. If bulls handle to reclaim $2,200 and push towards $2,500, a reversal may happen. Nevertheless, failure to carry $2,000 may see ETH drop additional, doubtlessly testing decrease demand zones within the coming weeks.

Value Testing Demand – Can Bulls Regain Management?

Ethereum is buying and selling at $2,120 after enduring days of large promoting strain that pushed the value to its lowest degree in months. ETH is at the moment holding above a high-timeframe demand degree round $2,000, an important zone that should be defended to keep away from additional draw back. Nevertheless, sentiment stays fragile, and if Ethereum fails to carry this degree, it may set off a dramatic sell-off resulting in even decrease costs.

Bulls face an pressing problem to regain management of worth motion. The $2,200 degree now acts as the primary key resistance, and a breakout above this mark could be step one towards stabilization. Past that, ETH should push above $2,500 as quickly as doable to verify a possible pattern reversal and sign the beginning of a restoration rally.

Associated Studying

If bulls fail to carry the $2,000 help, Ethereum may face elevated volatility and a steep decline, doubtlessly testing decrease demand zones. The subsequent few buying and selling periods might be vital, as ETH’s capacity to remain above key ranges will decide whether or not the market stabilizes or enters a deeper correction part within the coming weeks.

Featured picture from Dall-E, chart from TradingView