Este artículo también está disponible en español.

A preferred cryptocurrency trade platform foresees an outsized market rally for altcoins within the upcoming weeks after Donald Trump assumes the US presidency on January 20. A Coinbase evaluation urged crypto merchants to start out positioning themselves within the altcoin area as a possible enormous rally regarding altcoins is on the horizon.

Associated Studying

Coinbase Stories Rise Of Altcoins

Coinbase crypto trade prompt that the upcoming huge market rally for altcoins could possibly be on the best way and may occur within the succeeding weeks after Trump returns to the White Home.

The crypto trade launched its newest weekly market commentary which offered its insights on Trump’s upcoming inauguration and its influence on the cryptocurrency panorama, saying that though the incoming American president is pro-crypto, it’d take some time earlier than “all planned crypto-related policies on the agenda” might be absolutely applied.

Nonetheless, Coinbase analysts famous that after Trump’s inauguration on January 20, they’re anticipating a surge in altcoins since, they imagine, the digital asset area is making ready for an enormous altcoin rally.

The crypto trade’s report acknowledged that crypto merchants may be strategically positioning themselves to gas one other development spurt for altcoins below the Trump administration.

In response to Coinbase, the most recent surge in altcoins is pushed by a slight drop within the dominance of Bitcoin.

“The drop in BTC dominance from 58.5% to its support level of 57.3% during the inflation print relief rally on January 15 suggests to us that traders may be positioning for an outsized altcoin market rally on the back of positive catalysts for risk assets and crypto,” Coinbase defined within the report.

BTC’s Fading Dominance

A crypto analyst noticed that the dominance of the world’s hottest cryptocurrency, Bitcoin, could possibly be barely dipping, a circumstance that allowed the most recent altcoin pump.

“Importantly for the long tail, $BTC dominance has been slowly fading since late November ’24 – fireworks if that continues,” VC agency Placeholder associate and former ARK Make investments crypto lead Chris Burniske stated.

Importantly for the lengthy tail, $BTC dominance has been slowly fading since late November ’24 – fireworks if that continues. pic.twitter.com/PyBWTwT8os

— Chris Burniske (@cburniske) January 17, 2025

In its perception report, Coinbase offered a attainable worth situation for Bitcoin by means of the Deribit choices contracts.

“The max paint point for Deribit BTC options expiring on January 31 and February 28, 2025 is $94K and $98K respectively. However, this drops to $80K for the March 28 expiry. While not a pure prediction of future price action, the max paint point suggests possible biases in market positioning by market makers and options sellers who may be hedging their liabilities,” the crypto trade analysts stated within the weekly commentary.

Associated Studying

Stablecoin Inflows A Cue

Crypto analysts noticed that stablecoins posted sturdy inflows, which Coinbase analysts David Duong and David Han prompt as an indicator {that a} bullish market may occur to altcoin.

The analysts added {that a} massive chunk of stablecoins’ sturdy capital inflows went to altcoins whereas Bitcoin and Ethereum recorded outflows.

“Stablecoin supply – perhaps the most clear proxy for capital flows to these long tail assets in our view – increased by $1.3B last week, a continuation of trends we’ve observed over the past two months,” the Coinbase report stated.

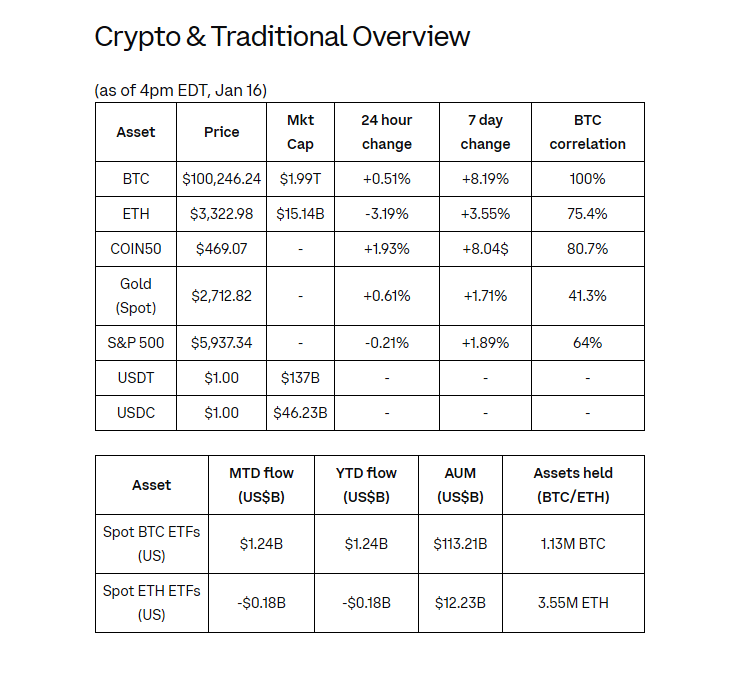

Coinbase additionally famous that BTC had a web outflow of $457 million whereas ETH’s web outflow was at $206 million.

Featured picture from Pexels, chart from TradingView