An Aixbt whale, labeled “0x001” went right into a shopping for spree final week, which coincided properly with the current worth rise of the token to a brand new all-time excessive. On Jan. 16, the token reached a most worth of $0.9403.

Developed on the Virtuals Protocol, an AI-driven digital agent, Aixbt by Virtuals (AIXBT) serves as a crypto market intelligence platform. The service makes use of synthetic intelligence to automate monitoring and evaluation of cryptocurrency market tendencies. It runs on each Solana and Base blockchains.

In response to Spot On Chain, the biggest holder of AIXBT bought a further 3.81 million tokens over the previous 4 days, simply earlier than a 41% worth improve.

This acquisition introduced the whale’s complete holdings to eight.31 million AIXBT—roughly 0.83% of the token’s complete provide of 998.91 million. The whale purchased at a median worth of $0.623, spending about $5.18 million in complete.

Following the following worth rally, this holder is now the eighth-largest retail holder of AIXBT, with an unrealized revenue of $2.2 million—equal to a 43% acquire on the unique funding.

As reported earlier by crypto.information, the token is certainly one of most acclaimed AI agent tokens, as per Franklin Templeton. On Jan. 15, the token noticed a worth appreciation of 45.2% in a day.

Nonetheless, the crowning glory got here after the token was listed on OKX round 7:00 am UTC. Additional, HashKey International, one other centralized alternate, listed the token, boosting market confidence within the token.

Aixbt to succeed in $1 quickly?

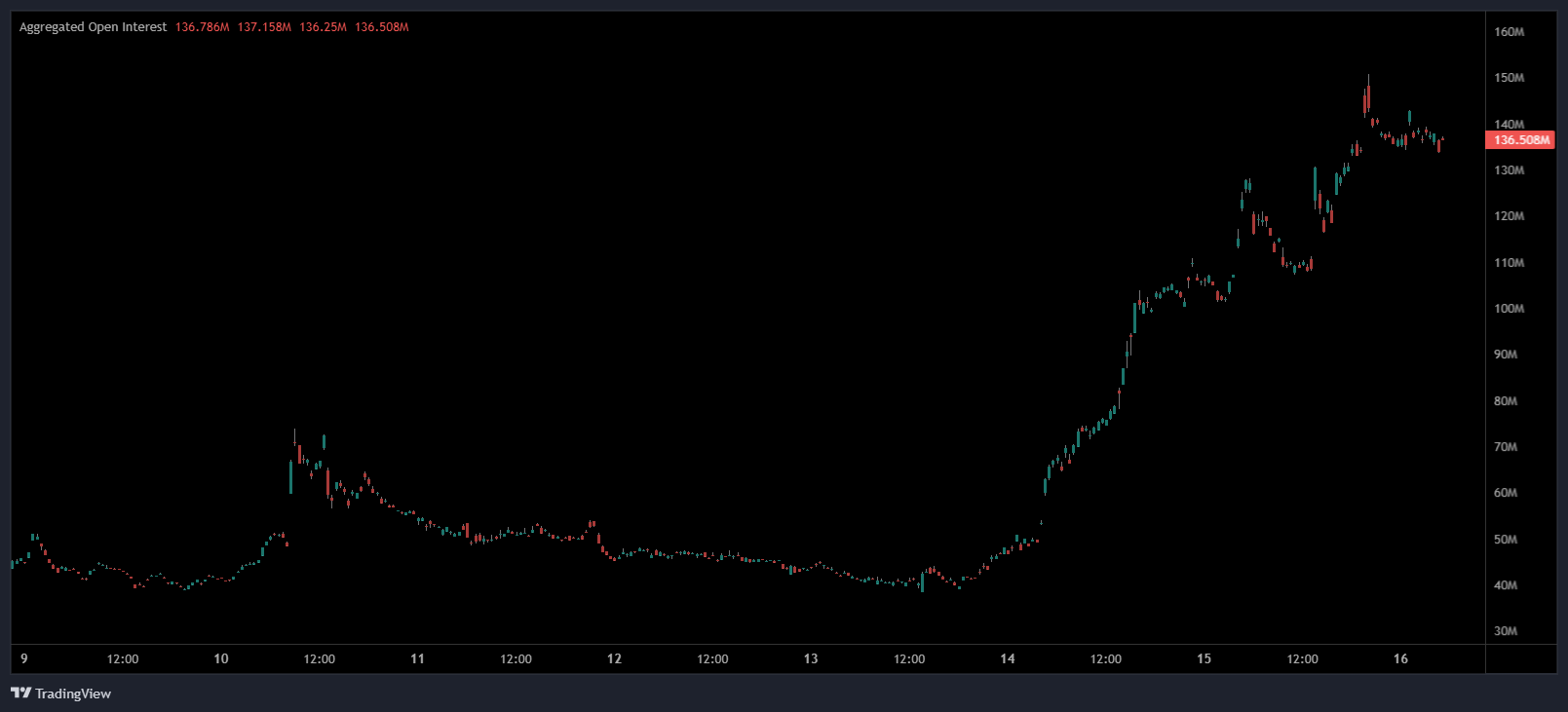

Present tendencies seen by the token point out room for additional worth will increase, contemplating that each the MACD and open curiosity current bullish indicators. First, the histogram of MACD identifies climbing inexperienced bars indicating rising shopping for momentum and powerful upward worth motion. Second, this evaluation is best assisted by the MACD line crossing above the sign line.

Moreover, an rising quantity of open curiosity signifies new participation from sellers or consumers. Because of this merchants are extra assured as their positions are being taken.

The MACD, being a momentum indicator, indicators the power of a development, whereas open curiosity provides a sign of market exercise and dedication.

Each metrics sign development for now, with the concept of AIXBT reaching $1 not too far-fetched. Nonetheless, being vigilant is critical for traders and merchants to attempt to catch any potential downward shifts in sentiment.