Este artículo también está disponible en español.

Solana has kicked off the yr with a powerful 12% surge, reaching the pivotal $210 degree and reigniting investor optimism. This rally comes as market sentiment shifts positively, fueling a broader resurgence in altcoins. With Solana now gaining vital traction, many are asking whether or not this marks the start of a large rally for the high-performance blockchain.

Associated Studying

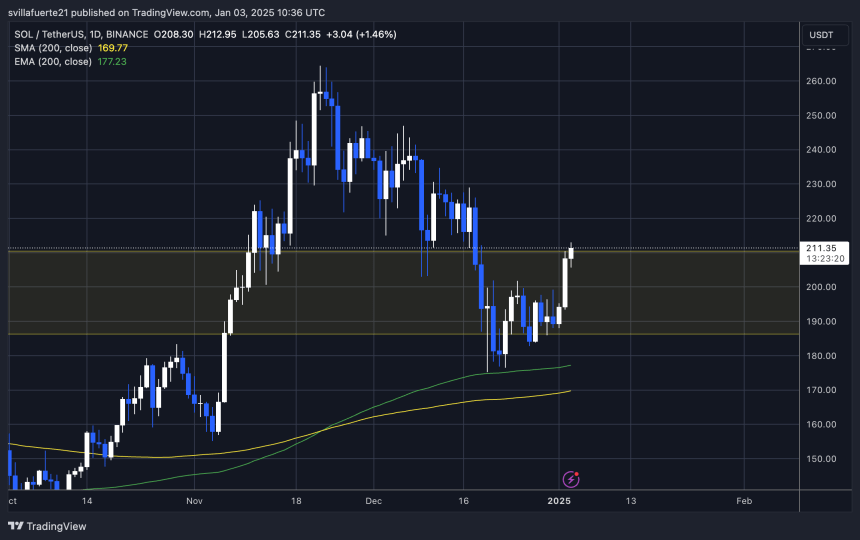

Prime analyst Jelle just lately shared a technical evaluation on X, highlighting a crucial improvement in Solana’s value motion. In accordance with Jelle, SOL has efficiently damaged a each day downtrend that originated after it reached its all-time excessive. This breakout is seen as a bullish sign, suggesting that Solana could also be gearing up for a extra prolonged upward transfer within the coming weeks.

The $210 mark is essential for Solana, as flipping it into assist might pave the way in which for a sustained rally. With altcoins exhibiting energy throughout the board, traders will probably be carefully watching Solana’s capacity to capitalize on this momentum. As the brand new yr unfolds, the query stays: can Solana leverage this bullish begin to obtain new highs and solidify its place as a number one drive within the crypto market?

Value Motion Suggests An Upcoming Transfer

Because the crypto market rebounds from native lows, Solana is using the wave with spectacular momentum. The altcoin large has continued to rise after holding a crucial demand degree above the $180 mark. This has sparked optimism amongst traders, who more and more view Solana as a resilient and promising asset within the present market atmosphere.

Prime analyst Jelle just lately shared an in depth technical evaluation on X, highlighting a number of bullish developments for Solana. In accordance with Jelle, SOL has not solely damaged out of its extended downtrend however has additionally reclaimed essential month-to-month and weekly assist ranges. Moreover, Solana is now buying and selling again above its 50-day exponential transferring common (EMA), signaling a renewed bullish construction and rising energy in its value motion.

These technical indicators recommend Solana is getting ready for a major transfer, probably driving the value to new all-time highs. Nevertheless, such a breakout would require sturdy market participation and favorable sentiment within the coming weeks to maintain the rally.

Associated Studying

For now, Solana’s efficiency is a testomony to its resilience, positioning it as a prime contender for these looking for development alternatives within the altcoin market.

Solana Testing Technical Ranges

The Solana (SOL) each day chart is exhibiting promising indicators of energy after a pointy bounce from the crucial $175 degree, which coincided completely with the 200-day EMA. This technical rebound has propelled the value to a key provide zone at $210, a major milestone as SOL continues to push greater.

For bulls, the instant goal should be the $230 degree. Reclaiming this space as assist would doubtless set off a quick and aggressive rally. Driving Solana into uncharted territory with new all-time highs. The confluence of technical indicators and up to date bullish momentum suggests this state of affairs is achievable if the broader market continues to assist the development.

Associated Studying

Nevertheless, time is of the essence. If Solana fails to reclaim the $230 mark within the coming weeks, the momentum might weaken, resulting in sideways consolidation. Such a consolidation section would possibly gradual the tempo however might additionally construct a stronger base for the subsequent breakout.

Featured picture from Dall-E, chart from TradingView