Este artículo también está disponible en español.

The Bitcoin value has dropped beneath the $100,000 psychological stage and is now holding between the $96,000 and $98,000 vary. Crypto analyst Ali Martinez supplied insights into why Bitcoin might be holding effectively inside this vary.

Why The Bitcoin Price Is Holding Steady Between $96,000 And $98,000

In an X publish, Ali Martinez famous that probably the most vital assist ranges for the Bitcoin value is between $98,830 and $95,830, the place 1.09 wallets purchased over 1.16 million BTC. This explains why Bitcoin is holding regular between $96,000 and $98,000 as buyers who purchased between this stage proceed to supply enormous assist for the flagship crypto.

Associated Studying

As Martinez steered, it is necessary for these holders to proceed to carry regular as a wave of sell-offs might ship the Bitcoin value tumbling even beneath $90,000. The flagship crypto dropped beneath $100,000 following the Federal Reserve Jerome Powell’s current speech, by which he hinted at a hawkish stance from the US Central Financial institution.

This sparked a large wave of sell-offs, as a Hawkish Fed paints a bearish image for threat property like Bitcoin. Nonetheless, regardless of the Bitcoin value drop beneath, most Bitcoin holders stay in revenue, which is a constructive for the flagship crypto. IntoTheBlock knowledge exhibits that 86% of Bitcoin holders are within the cash, 4% are out of the cash, and 9% are on the cash.

These Bitcoin holders nonetheless appear bullish on the main crypto as they proceed to build up extra BTC. In an X publish, Ali Martinez said that to this point in December, 74,052 BTC have been withdrawn from exchanges, and this development doesn’t appear to be slowing down.

Merchants Anticipate A Bullish Reversal

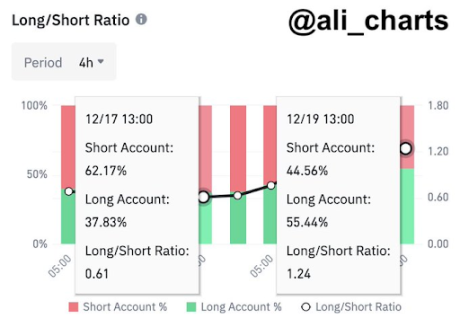

Ali Martinez steered that crypto merchants anticipate a bullish reversal for the Bitcoin value from its present stage. This got here as he revealed that merchants on Binance nailed the highest, with 62.17% shorting Bitcoin whereas it was buying and selling at $108,000. Now, Martinez said that sentiment has flipped, with 55.44% of those buying and selling now longing dips beneath $96,000.

Associated Studying

In the meantime, it’s essential for the Bitcoin value to carry this $96,000, as Martinez warned that if BTC loses this assist, it might drop beneath $90,000. The analyst said that primarily based on the Fibonacci stage, if Bitcoin loses $96,000, the subsequent level of focus turns into $90,000 and $85,000. In the meantime, from a bullish perspective, crypto analyst Justin Bennett steered that the $110,000 goal continues to be in focus for the Bitcoin value.

On the time of writing, the Bitcoin value is buying and selling at round $97,000, down over 3% within the final 24 hours, based on knowledge from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com