Bitcoin is as soon as once more testing a crucial resistance zone, buying and selling slightly below its all-time excessive of $112,000. After a robust rebound from June lows, bulls have reclaimed key ranges and at the moment are eyeing a decisive breakout into worth discovery. Nevertheless, the trail ahead is something however clear. Whereas sentiment stays broadly optimistic—supported by a positive macro backdrop and renewed energy in US equities—Bitcoin should ship a transparent push above its historic peak to verify the beginning of a brand new expansive part.

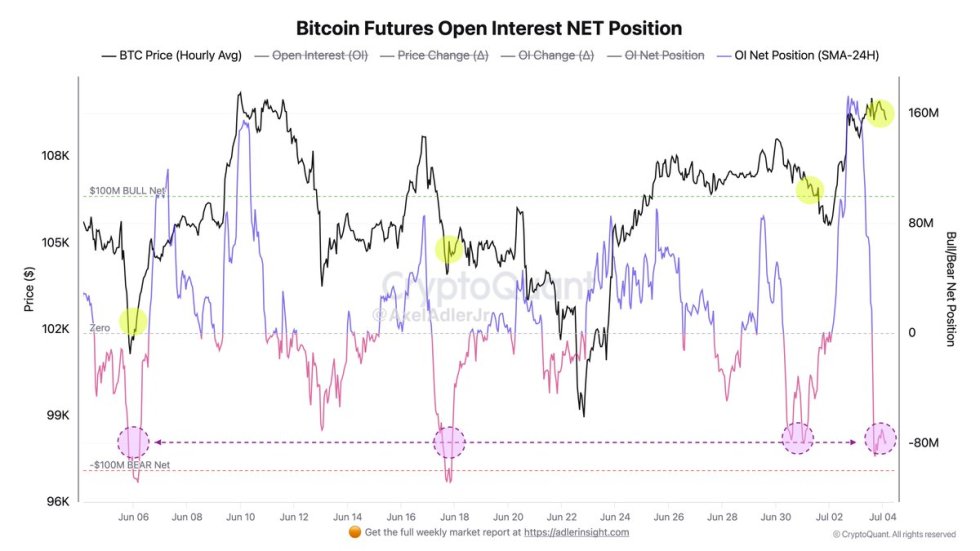

In response to information from CryptoQuant, futures markets are displaying indicators of hesitation. Bears have opened a big quantity of quick positions, betting towards a breakout at present ranges. Apparently, regardless of this enhance briefly publicity, Bitcoin’s worth stays secure, displaying resilience within the face of promoting stress. This standoff between bulls and bears is prone to decide the path of the market within the days forward.

A clear break above $112K might set off a wave of liquidations, fueling a speedy transfer into uncharted territory. Conversely, a failed breakout might invite a deeper correction. All eyes at the moment are on this resistance zone, the place Bitcoin’s subsequent large transfer will likely be determined.

Bitcoin Consolidates Under All-Time Excessive as Market Awaits Directional Transfer

Bitcoin is presently locked in a crucial consolidation part slightly below its all-time excessive of $112,000. For a number of weeks, worth motion has remained tight, oscillating between $103K and $111K, suggesting sturdy indecision amongst market individuals. This extended sideways motion close to the prime quality factors to important resistance, with bulls struggling to realize momentum and push the value into discovery.

Prime analyst Axel Adler shared futures market information revealing that bears have opened a big quantity of quick positions, anticipating a rejection on the all-time excessive. Regardless of this bearish stress, Bitcoin has proven outstanding stability, dipping solely barely from $110K to $108K in latest classes. This resilience implies that whereas bearish bets are growing, patrons stay lively and prepared to soak up promote stress, holding the construction intact for now.

The market is break up. On one aspect, bullish analysts argue that Bitcoin is coiling for a breakout, and a clear push above $112K might set off a surge pushed by liquidations and renewed institutional flows. On the opposite hand, bearish commentators warn that the failure to interrupt out might result in a pointy correction, doubtlessly dragging BTC beneath the $100K degree.

With volatility compressed and macro situations favoring danger belongings, the approaching days are prone to be decisive. A breakout or breakdown from this vary will set the tone for the remainder of the summer season. Till then, Bitcoin continues to construct stress beneath its all-time excessive, with each bulls and bears watching intently for the following transfer.

BTC Checks Resistance After Failed Breakout Try

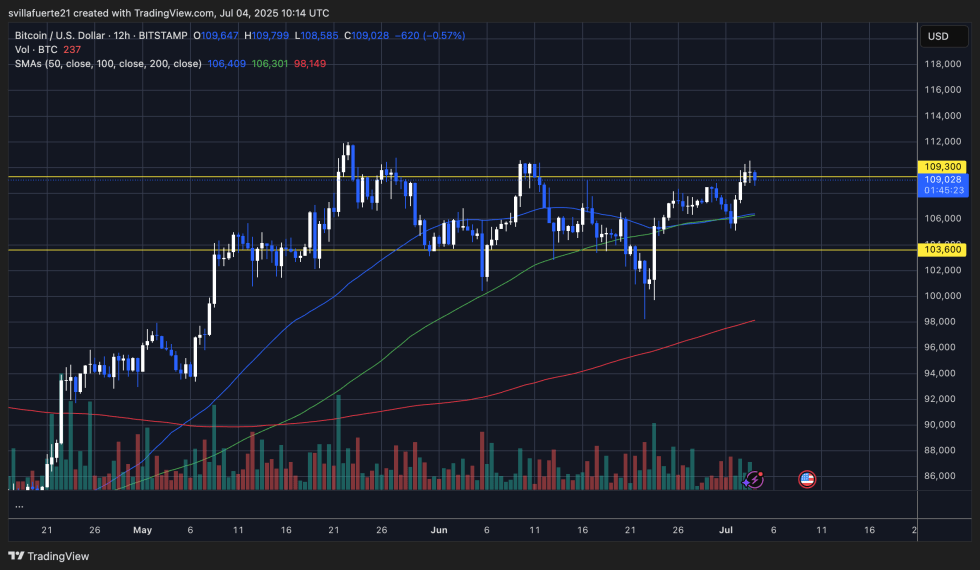

Bitcoin is presently consolidating close to the $109,000 degree after briefly pushing above short-term resistance at $109,300. As proven within the 12-hour chart, worth motion has been struggling to interrupt by means of this degree since early Might, with repeated rejections forming a transparent horizontal barrier. Regardless of a number of makes an attempt, bulls haven’t but been in a position to maintain a transfer above the vary highs close to $110K–$112K.

The 50, 100, and 200-period SMAs on the 12H chart all slope upward, with worth presently sitting above all three—a optimistic signal of underlying bullish construction. Nevertheless, quantity has began to say no, which can point out a weakening of momentum or a wait-and-see method by merchants forward of a serious transfer.

Assist is holding across the $103,600 zone, which beforehand served as a key resistance and now acts as a base for potential upside continuation. The compression between $103K and $110K is forming a decent vary, sometimes a precursor to a robust breakout.

If bulls handle to flip $109,300 into help, a retest of the $112K ATH seems doubtless. Nevertheless, failure to interrupt greater might invite renewed promoting stress, particularly if quick positions proceed to construct. The following few classes stay crucial for Bitcoin’s directional bias.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.