Bitcoin is presently buying and selling 6% under its $112,000 all-time excessive, holding regular however displaying indicators of exhaustion because it struggles to interrupt into new worth discovery. Whereas worth motion stays robust, the market lacks the momentum wanted for a decisive upward transfer. Macroeconomic uncertainty continues to weigh closely on investor sentiment, with rising US Treasury yields, the Federal Reserve’s ongoing stance on elevated rates of interest, and escalating conflicts within the Center East all contributing to a posh and risk-sensitive surroundings.

In accordance with prime analyst Darkfost, whereas some traders have been noticed taking earnings yesterday, the promoting stress stays comparatively delicate. On-chain metrics point out that the majority individuals proceed to carry their positions, reflecting a typically bullish longer-term outlook. Nevertheless, the important thing problem maintaining Bitcoin from breaking larger seems to be weak demand.

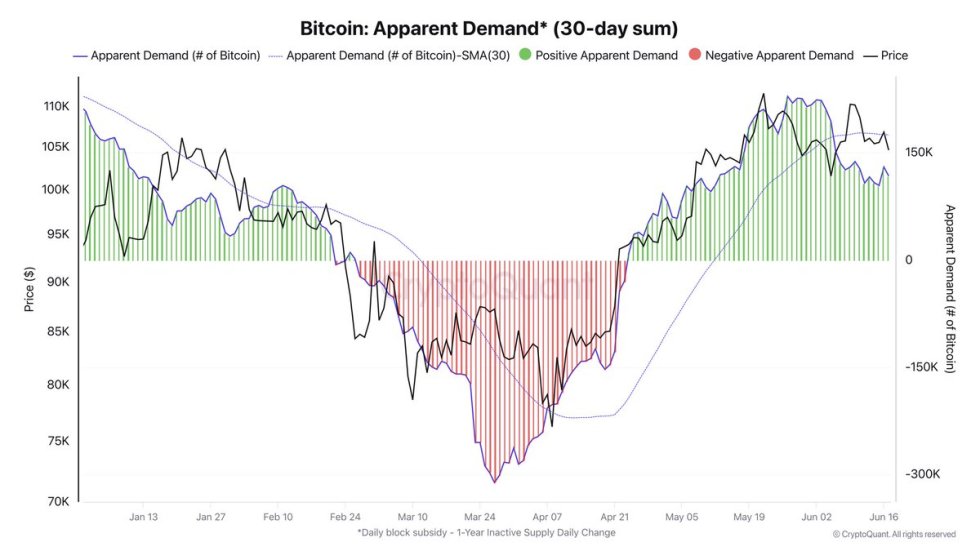

A detailed have a look at current information reveals that whereas provide stays restricted, new purchaser influx has slowed. This imbalance is stopping a breakout and suggests {that a} recent wave of demand will probably be required to ignite the subsequent leg up. Till that happens, Bitcoin could proceed consolidating inside its present vary as merchants await readability from each macro and geopolitical fronts.

Bitcoin Consolidates Above $100K as Demand Weakens

Bitcoin has constantly held above the $100,000 stage since early June, signaling {that a} new worth equilibrium could also be forming. Regardless of the robust efficiency—up 40% for the reason that April lows—the value has struggled to interrupt by way of the $112,000 all-time excessive, elevating questions in regards to the sustainability of the present development. The longer BTC fails to reclaim new highs, the better the chance of a breakdown under $100K, particularly if broader macroeconomic and geopolitical pressures intensify.

Darkfost shared insights highlighting a shift in market conduct. Whereas there was a quick uptick in profit-taking yesterday, the quantity remained comparatively low. This implies that the majority traders are nonetheless inclined to carry, indicating confidence in Bitcoin’s longer-term trajectory. Nevertheless, a key issue stopping upward continuation is the seen weak spot in demand.

Darkfost pointed to a chart evaluating new provide to the over 1-year inactive provide, used to measure relative demand power. When this ratio climbs above zero, it usually alerts rising demand. Nevertheless, since the latest native prime in Might, this metric has been step by step declining. Though demand stays wholesome sufficient to soak up present promoting stress, it’s inadequate to drive one other breakout.

At current, Bitcoin seems locked in a state of stability, supported by regular holder conviction however restrained by subdued new purchaser exercise. If demand returns with power, a breakout towards new highs might observe. Till then, the market stays in wait-and-see mode.

BTC Worth Evaluation: Key Help Nonetheless Holding But Momentum Weak

Bitcoin is presently buying and selling round $104,827, displaying indicators of hesitation because it consolidates simply above the important thing help zone close to $103,600. This stage, which aligns with a earlier all-time excessive, continues to behave as a crucial line within the sand for bulls. The 12-hour chart reveals repeated assessments of this help since early June, every time adopted by a restoration, however with out significant follow-through to the upside.

The 100-period shifting common (inexperienced line) is offering dynamic help simply above $104,200, whereas the 50-period MA (blue line) now acts as overhead resistance round $106,269. This squeeze between shifting averages signifies a tightening vary, and a breakout — up or down — might happen quickly. Quantity stays comparatively low, which suggests an absence of conviction from each consumers and sellers.

Upside stays capped by the $109,300 resistance stage, which Bitcoin did not reclaim in a number of current makes an attempt. A clear break above this stage might reignite bullish momentum towards worth discovery. Nevertheless, continued failure to breach that zone, mixed with world uncertainty and weakening demand, will increase the chance of a breakdown under $103,600 — opening the door to a deeper correction. For now, Bitcoin holds the road, however stress is constructing.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.