Bitcoin continues to point out resilience regardless of heightened volatility attributable to the continued battle between Israel and Iran. The geopolitical rigidity has led to sharp strikes throughout world markets, however BTC has held agency above the $105,000 degree. This worth motion means that the market is in a ready section—buyers are cautious however not promoting aggressively, presumably awaiting extra readability earlier than committing to the following main transfer.

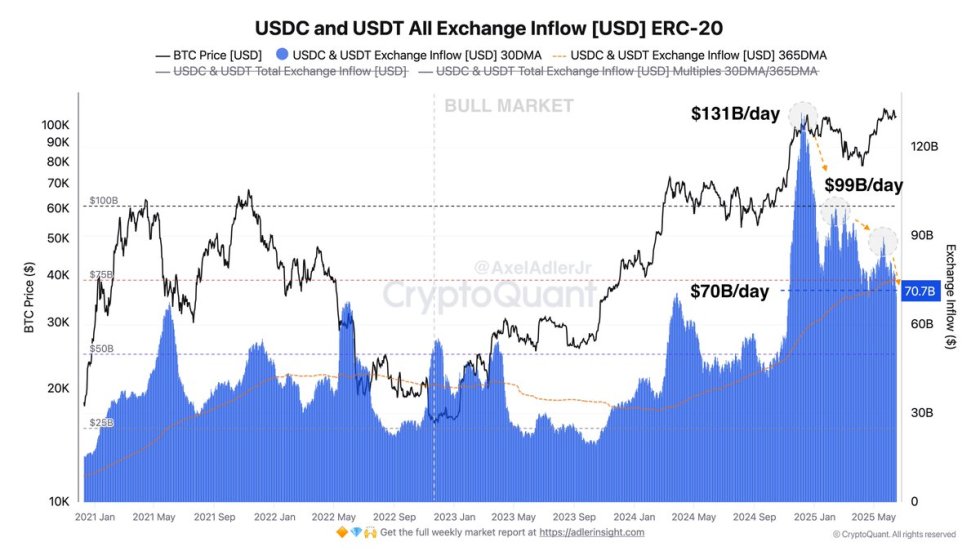

Prime analyst Axel Adler shared necessary liquidity information that helps clarify the present market temper. In December 2024, when BTC traded between $98K and $100K, the common every day inflows of USDT and USDC into centralized exchanges (CEXs) hit a document excessive of $131 billion. This inflow of stablecoins signaled intense shopping for stress and bullish momentum on the time.

Nevertheless, by June 2025, every day inflows have cooled down considerably to round $70 billion—$5 billion under the 365-day common and a staggering $61 billion under the December peak. This drop signifies a pure slowdown in exchange-directed liquidity, which usually fuels worth rallies. But, with Bitcoin nonetheless holding above $105K, it seems market individuals stay assured, and the present section could merely replicate consolidation earlier than the following breakout.

Bitcoin Consolidates Amid Uncertainty And Slower Liquidity Flows

Bitcoin has entered a consolidation section following an expansive rally that lifted costs from the $74,000 degree to an all-time excessive close to $112,000. This pullback comes amid a posh macroeconomic setting marked by rising US Treasury yields, inflation fears, and escalating geopolitical tensions, notably the unfolding battle between Israel and Iran. These overlapping dangers have weighed closely on investor sentiment, making the approaching weeks pivotal in figuring out Bitcoin’s subsequent main transfer.

Regardless of the volatility, many analysts stay optimistic, anticipating Bitcoin to reclaim its earlier highs and enter worth discovery. Market individuals proceed to observe on-chain and liquidity metrics to gauge sentiment and conviction.

One key perception comes from Axel Adler, who shared that again in December 2024—when BTC traded within the $98K–$100K vary—every day inflows of USDT and USDC into centralized exchanges peaked at $131 billion. As of June 2025, these flows have dropped to $70 billion per day, which is $5 billion under the 365-day common and $61 billion below the December excessive.

This notable decline in liquidity displays a cooling of speculative momentum. Nevertheless, BTC holding above $100K means that long-term holders stay dedicated, and widespread promoting has not occurred. This indicators that the market could also be present process a wholesome interval of base-building earlier than one other breakout.

Worth Motion Stays Regular Inside Key Vary

The 12-hour Bitcoin chart reveals BTC buying and selling at $106,881, holding above the important thing $103,600 assist degree that has acted as a base since late Might. Regardless of current volatility attributable to geopolitical tensions and macroeconomic uncertainty, Bitcoin stays in a consolidation zone between $103,600 and $109,300, respecting each the decrease and higher boundaries of this vary.

Worth is at present pushing off the 100-day SMA (inexperienced line), indicating that consumers are stepping in at dynamic assist ranges. A bullish crossover of the 50-day and 100-day SMAs additional helps short-term upward momentum. Nevertheless, BTC remains to be buying and selling under the $109,300 resistance, which continues to behave as a robust provide zone. A decisive breakout above this degree might verify development continuation and set the stage for an additional check of the all-time excessive at $112K.

Quantity stays comparatively secure however lacks the power seen in prior impulsive strikes. If Bitcoin can construct momentum and shut above $107K with sturdy shopping for quantity, it could pave the way in which for a breakout. On the draw back, a lack of $103,600 would invalidate the present construction and certain result in additional retracement towards the 200-day SMA, at present close to $94,000. For now, the construction favors affected person bulls.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.