Bitcoin costs are steady, recovering after the dip final week. Though whales are promoting, there may be sturdy demand from establishments and Technique who’re accumulating. Will BTCUSDT rise to $120,000?

Bitcoin bulls took a success on Friday, promoting off sharply. Nonetheless, patrons rapidly stepped in over the weekend, stabilizing costs earlier than a restoration earlier at this time.

Regardless of this refreshing bounce, merchants await extra affirmation earlier than doubling down, anticipating one other wave of upper highs above $112,200 to $120,000. If bulls take off, a number of the finest Solana meme cash may rip to recent all-time highs.

(BTCUSDT)

Why Are Bitcoin Whales Selling?

Although bullish, Glassnode analysts recommend bulls would possibly wait longer if the present value motion persists.

Their evaluation notes highly effective market shifts as whales, key value drivers after the approval of spot Bitcoin ETFs in early 2024, look like cashing out.

On X, Glassnode reveals that Bitcoin whales holding not less than 10,000 BTC have shifted to web promoting, with a pockets circulate metric of round 0.3.

As of Could 26, the >10K $BTC cohort has pivoted to web distribution (~0.3), signaling a notable shift in positioning among the many largest holders. Aside from that, accumulation stays broad, however management is shifting down the pockets dimension curve:

>10K BTC: ~0.3

1K–10K BTC:… pic.twitter.com/VxEy2LHcFE

— glassnode (@glassnode) Could 26, 2025

Whales holding between 1,000 and 10,000 BTC are additionally slowing down, with their pockets circulate metric dipping to 0.8.

Equally, whales holding 100 to 1,000 BTC present a drop to 0.7.

This across-the-board decline in accumulation means that, regardless of record-high costs, the upward momentum is slowing down as whale exercise fades.

The dip in accumulation might trace that Bitcoin is in a late-stage bull run, with massive gamers taking earnings in anticipation of a capital rotation.

Will Establishments Drive BTC to $120,000?

Apparently, establishments stay lively, shopping for aggressively, serving to create demand for a number of the finest meme coin ICOs.

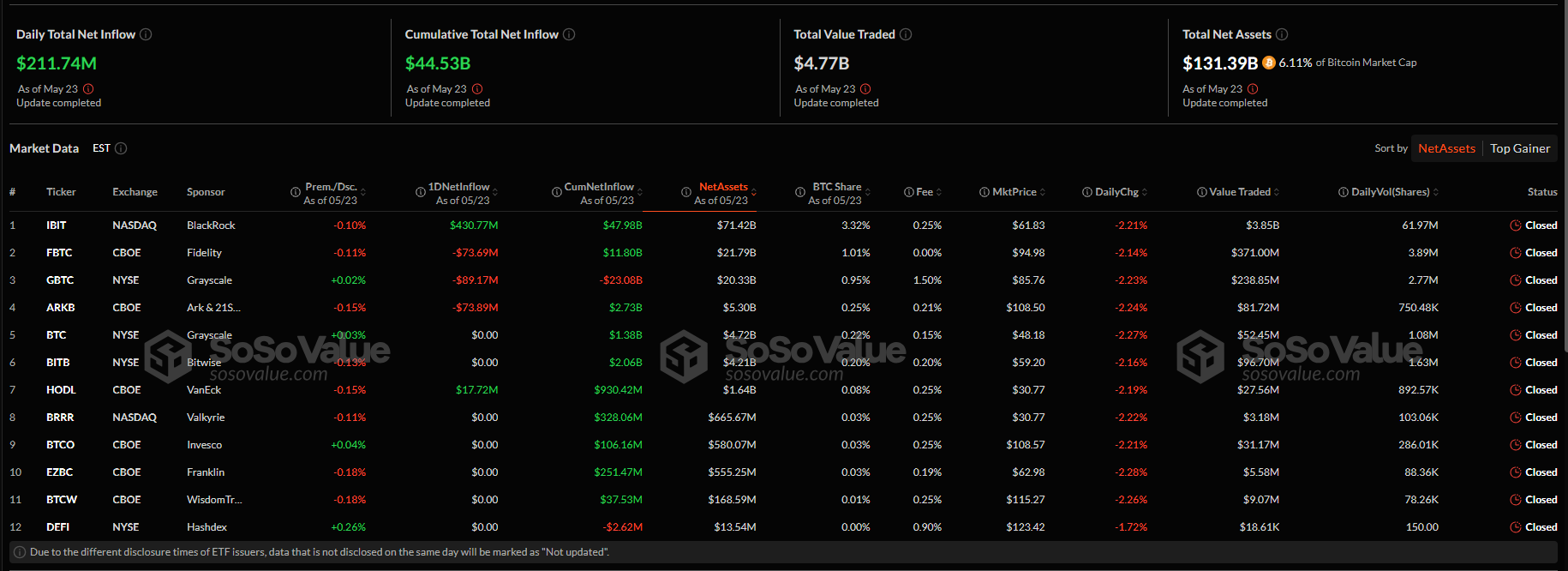

As of Could 23, SosoValue information exhibits over $211 million in spot Bitcoin ETF purchases, primarily by way of BlackRock.

Different issuers, together with Constancy and Grayscale, posted outflows. Institutional engagement typically stabilizes costs by locking up provide, making a welcome flooring.

(Supply)

If inflows proceed this week, they may counter whale distribution, take up promoting strain, and pave the best way for features above $112,500 to $120,000.

This enlargement could be a aid for retail traders, as short-term holders, or addresses that purchased Bitcoin throughout the final three months, are at the moment up 27%. Traditionally, short-term holders, largely speculators, promote when earnings exceed 40%, triggering volatility.

(Supply)

An analyst on X predicts value features over the subsequent two weeks, projecting a breakout by mid-June that might push speculators into profitability and set off profit-taking.

If establishments and whales take up this promoting, the market may keep away from a serious correction, lifting costs to new all-time highs.

This situation is supported by recent capital coming into the market, much like July–December 2024. Over 420,000 BTC clustered round $94,000 supplies assist in case of a sell-off.

(Supply)

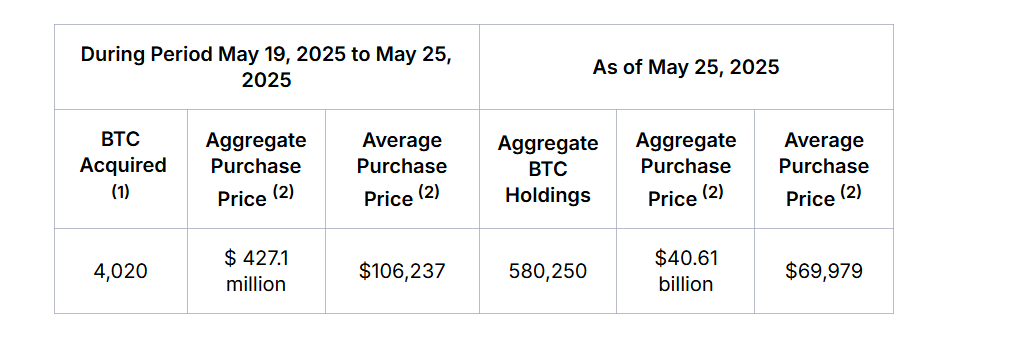

Technique, previously MicroStrategy, bolstered the case for extra features, shopping for extra BTC.

(Supply)

They purchased $427 million value of BTC, elevating their common value to $106,000 and pushing their holding to $580,250 BTC.

DISCOVER: 10 Finest Crypto Presales to Put money into Could 2025 – High Token Presale

Bitcoin Whales Selling As Establishments Purchase: BTCUSDT To $120k?

- Bitcoin costs stabilize after dip

- Bitcoin whales distributing

- Establishments and Technique loading up

- BTCUSDT may spike to $120,000 if bulls win

The submit Bitcoin Stagnates, But as Some Whales Sell, Fresh Capital Enters: Up Next, $120,000? appeared first on 99Bitcoins.