The Bitcoin value is believed to have at all times moved in a cyclical sample — outlined by distinct durations of upward, sideways, and downward actions — since its creation. Nonetheless, this cycle concept seems to be underneath risk, with the premier cryptocurrency seemingly transferring towards the pattern.

CryptoQuant founder Ki Younger Ju, who had proclaimed that the BTC bull cycle is over in March 2025, reviewed his evaluation and floated the concept that the Bitcoin value may escape of the same old cyclical developments. One other on-chain professional on the X platform has weighed in with an attention-grabbing take about BTC’s cyclical behaviors.

Investors May See The First Distinctive Cycle In Bitcoin’s Historical past

Pseudonymous on-chain analyst Darkfost took to X to share their perspective on the present cycle and Bitcoin value probably breaking the fractal cycle dynamics. Based on the web pundit, the present market cycle might be totally different from the standard cycles seen previously, however maybe not as a lot as traders assume.

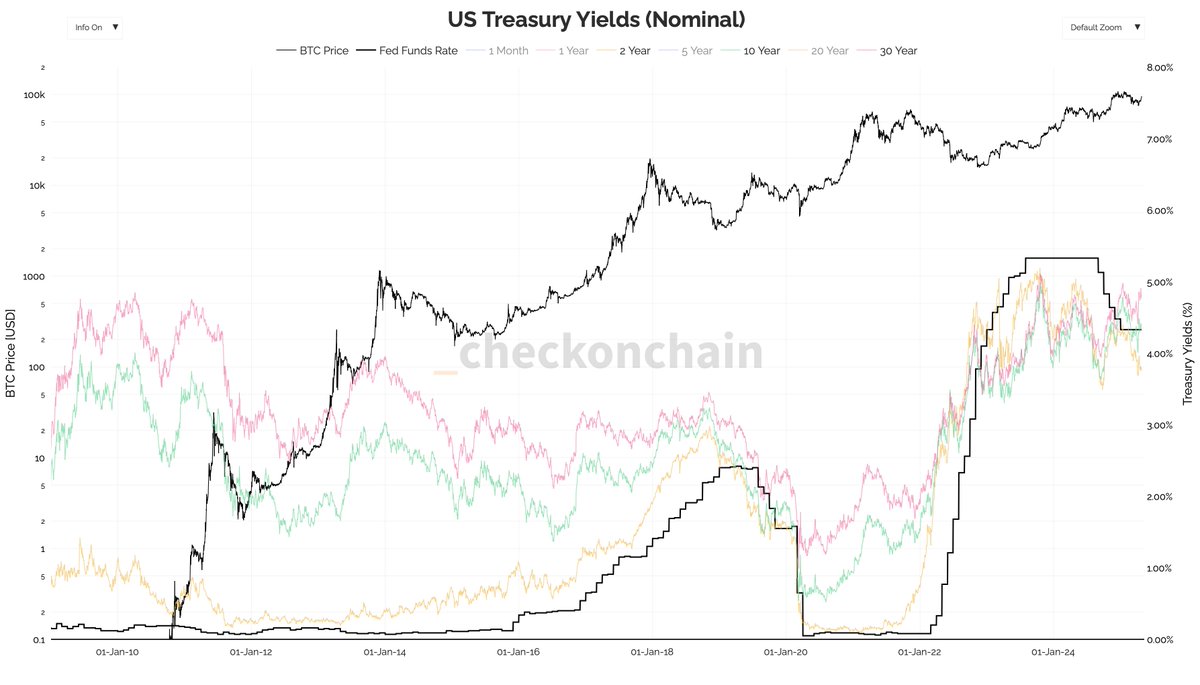

Darkfost based mostly their evaluation on the highlighted chart, which brings collectively key macroeconomic information and compares it to Bitcoin’s value actions. Firstly, the on-chain analyst believes that the flagship cryptocurrency has by no means needed to evolve underneath market circumstances this hostile for threat property.

Supply: @Darkfost_Coc

Darkfost alluded to the excessive rates of interest by the US Federal Reserve, saying the potential juicy returns on safer funding devices haven’t stopped the Bitcoin value from reaching two new all-time highs within the present cycle. Particularly, the crypto analyst pointed to the scenario with Treasury yields.

Darkfost stated:

Why would massive cash, particularly establishments, be prepared to take dangers after they may earn a protected 5% yield with none actual threat? What’s much more placing is that the US2Y has been greater than long-term yields, an uncommon and traditionally vital setup.

Darkfost went additional to say that the present cycle would possibly certainly be totally different, as liquidity has not been fully directed in direction of threat property. Nonetheless, this has not stopped the premier cryptocurrency from performing impressively previously 12 months.

In the tip, Darkfost talked about that the reelection of United States President Donald Trump brings some degree of uncertainty to the market. The on-chain analyst concluded that whereas Bitcoin stays in a typical cycle for now, traders may see the primary actually distinctive cycle if macro circumstances enhance this 12 months and final until 2026.

BTC Price At A Look

As of this writing, Bitcoin is valued at round $94,752, reflecting a roughly 0.5% value decline previously 24 hours.

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture created by DALL-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.