Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

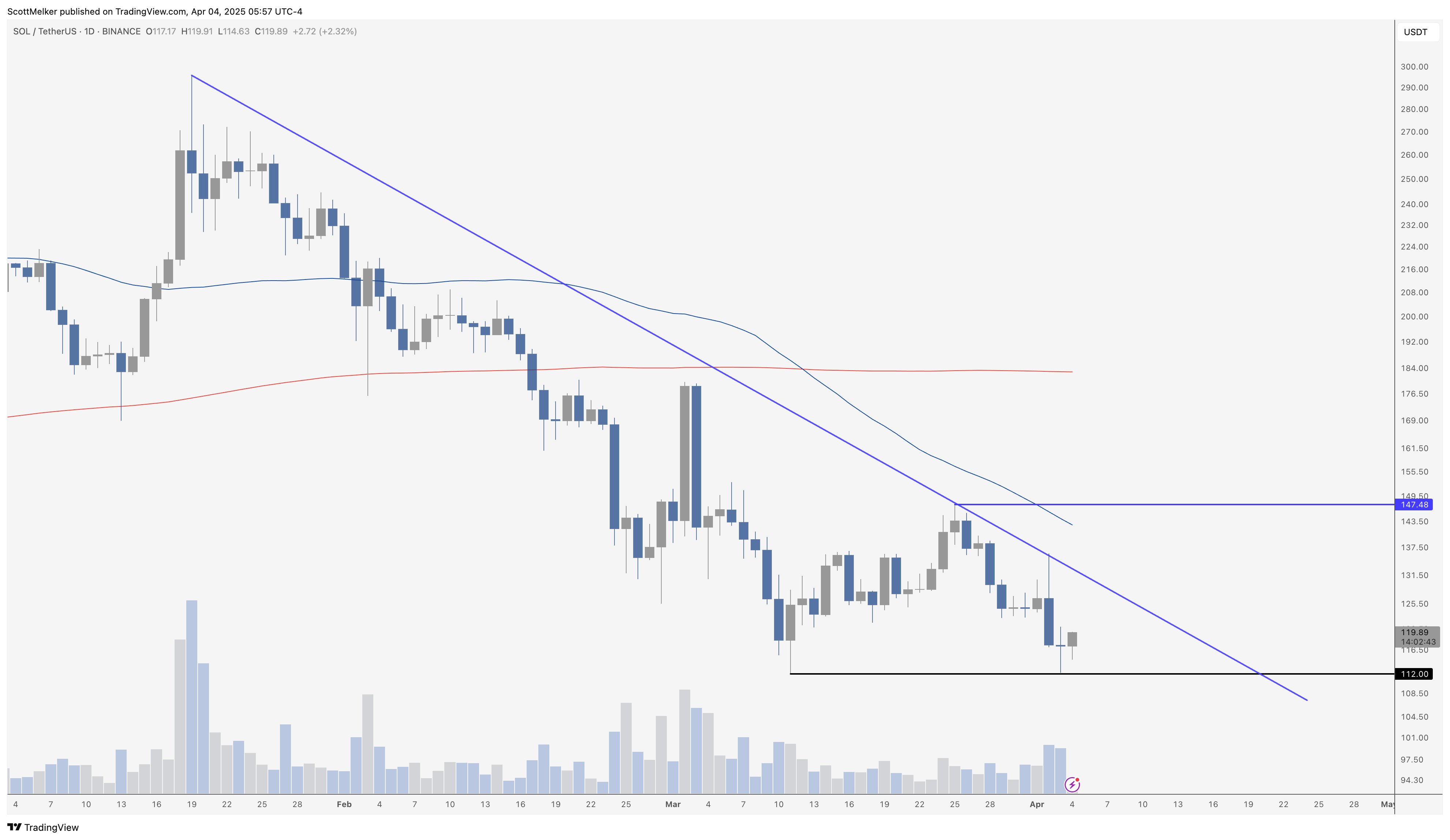

In a brand new technical evaluation shared through X, crypto analyst Scott Melker aka The Wolf Of All Streets (@scottmelker) highlighted a crucial support-resistance setup for Solana (SOL), emphasizing what he views as a textbook bounce off of a key technical degree. “Picture perfect bounce off of $112 support. Double bottom would confirm with a break above $147, the swing high between the two bottoms. Don’t let anyone call it a double bottom until that happens. Regardless, nice bounce off of support with defined resistance to watch,” Melker acknowledged.

The analyst’s chart exhibits SOL rebounding from close to $112, reinforcing that zone as vital short-term help. For a bullish double-bottom sample to validate, Melker factors to a breakout above the downtrend line (at the moment round $130). If SOL breaks this resistance, $147 would be the crucial degree that may have to be breached. Till then, he advises warning about prematurely labeling the formation as a confirmed double backside.

Solana Bottom In?

Notably, these remarks come on the heels of unlocks. In line with a publish by on-chain intelligence agency Arkham on Thursday, “$200M OF SOL UNLOCKING TOMORROW. Tomorrow (4th April) marks the largest single-day unlock of staked SOL until 2028. These 4 accounts staked a total of $37.7M of SOL in April 2021, and are up 5.5x at current prices.” The scale of those unlocks has generated appreciable dialogue on social media.

Associated Studying

One other dealer, NooNe0x, took a extra optimistic stance, remarking, “SOL unlocks. Looking at the bright side, today’s unlock was the last large block. Today alone is as much as 40% of everything that is still left. It is 78% done, May, June and

Traditionally, main token unlock occasions—whether or not for Solana or different tasks—have usually been anticipated properly prematurely by merchants and buyers. Markets “price in” that enormous holders promote their outdated tokens, typically driving costs decrease forward of the particular unlock. As soon as the unlock date arrives, if the anticipated sell-off doesn’t materialize as severely as feared (or if a lot of the unlocked stake stays off the market), costs have tended to stabilize and infrequently get better within the days or even weeks that comply with.

Associated Studying

This sample emerges as a result of many holders, particularly bigger or early buyers, could decide to restake or maintain onto their tokens in the event that they keep a robust elementary outlook. In the meantime, short-term merchants who had been betting on unlock-related volatility may shut positions as soon as the occasion passes. This “buy the rumor, sell the news” (or vice versa) dynamic can result in value whipsaws round unlock durations, however no single consequence is assured; a lot will depend on how a lot precise promoting stress surfaces and broader market sentiment on the time.

In the meantime, Awawat, a dealer and angel investor at APG Capital, cautioned that Solana might be in a precarious place regardless of holding above $100. “SOL absolutely shrekt – broke 170 range low, bounced at 120 a few times – now holding above 100 but the ice is thin – last big unlock tomorrow – will bid sub-100 if given but this looks rough given the state of the trenches,” he wrote.

At press time, SOL traded at $115.

Featured picture from Shutterstock, chart from TradingView.com