Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Tony “The Bull” Severino, a well-followed crypto analyst, lately took to the social media platform X to share an in depth breakdown of Bitcoin’s historic worth conduct. The evaluation makes use of a cyclical lens that many within the crypto neighborhood (each bulls and bears) agree holds important relevance.

Notably, Tony Severino focuses on the idea of Bitcoin’s four-year cycles and the way troughs and crests have constantly marked the durations of biggest alternative and biggest dangers for investing in Bitcoin. This evaluation is available in gentle of Bitcoin’s latest worth correction beneath $90,000 in March.

Cycles Outline Sentiment: From Troughs Of Alternative To Crests Of Threat

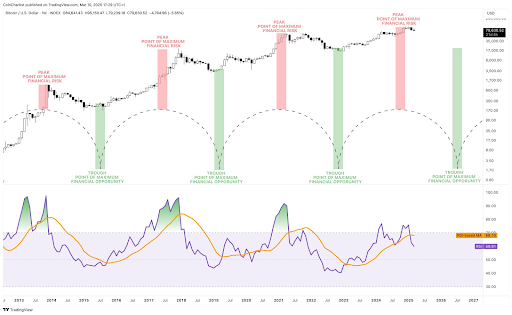

Severino’s evaluation begins from a foundational perception shared throughout the crypto business. The widely-held perception is that Bitcoin operates in clearly outlined cycles, normally lasting round 4 years, principally in relation to its halving cycles. His technical outlook relies on Bitcoin’s cycle indicator on the month-to-month candlestick timeframe chart that goes way back to 2013.

Associated Studying

As proven within the chart beneath, Bitcoin has gone by 4 definitive cycles in its historical past. These cycles, he explains, must be seen from “trough to trough.” The troughs are the darkest moments out there, however additionally they symbolize the purpose of most monetary alternative.

As these cycles progress, Bitcoin transitions by durations of accelerating optimism, ultimately arriving at what the analyst calls the “cyclical crest.” These crests, highlighted in purple in his chart, are the durations the place Bitcoin has reached its level of most monetary danger. That is relayed within the ensuing worth actions, with the Bitcoin worth topping out proper after passing every cyclical crest.

Bitcoin handed by its crest within the present market cycle simply earlier than reaching its all-time excessive of $108,786 in January 2025. If previous cycles are any indication, the approaching months may reveal whether or not a prime is already in.

Proper-Translated Peaks: Is BTC Operating Out Of Time In This Cycle?

Bitcoin has been on a correction path since February and is at the moment down by 20% from this $108,786 worth excessive. The Bitcoin worth has even gone forward to appropriate as little as $78,780 within the second week of March, triggering reactions as as to whether the crypto has already reached its peak worth this cycle.

Associated Studying

Nevertheless, Bitcoin would possibly not be within the woods but, as not all crests are {followed} instantly by market tops. Severino identified that previous cycles have featured “right-translated” peaks the place Bitcoin continued to rise barely even after crossing the crest. The 2017 bull run was essentially the most right-translated, with worth motion staying sturdy for a while after the red-zone crest. In distinction, different cycles started reversing not lengthy after reaching this level of most danger.

Bitcoin seems to have already handed the purple crest based mostly on Severino’s mannequin, however this doesn’t verify a prime is in simply but. As an alternative, it implies that the margin for error is quickly narrowing. The longer BTC continues to appropriate after this level, the extra elevated the danger of a bearish part turns into.

BTC is making an attempt to regain bullish momentum on the time of writing, buying and selling at $87,300 after rising 3.6% up to now 24 hours. Many different analysts argue that the Bitcoin worth may nonetheless chart larger territory this 12 months earlier than a definitive prime is confirmed.

Featured picture from iStock, chart from Tradingview.com