Bitcoin, Ethereum, and even meme coin costs usually are not transferring as quickly as they had been again in December. Bitcoin is clawing again beneficial properties, whereas Ethereum stays under $3,000.

Solana is underneath stress, buying and selling under a multi-month assist stage, whereas meme cash have dropped to round $75 billion in cumulative market cap.

Meme Coin Merchants Unwinding Their Longs: Time to Promote

Merchants are apprehensive, and with the danger of a pointy correction that may probably flush out speculators, Glassnode analysts have famous one more growth.

Positions are being unwound on exchanges like Binance, OKX, and Bybit, the place merchants can place leveraged trades. Whereas this development is widespread, there’s a notable decline in futures open curiosity amongst meme cash.

Within the final month alone, meme coin open curiosity has fallen a staggering 52%, and that quantity might rise additional now that Dogecoin, TRUMP, PEPE, and even WIF costs have dropped double digits previously week alone.

(Supply)

The drop in open curiosity factors to a shift in sentiment. Since crypto costs are delicate to hype, the extra merchants select to remain on the sidelines, the quicker costs are likely to fall. Over 11.1% of leveraged Bitcoin trades have been closed within the final month throughout a number of exchanges.

In the meantime, over 23% of leveraged ETH positions have been closed, whereas meme coin merchants are scrambling to exit, with over 52% of positions closed for the reason that TRUMP meme coin launched. Notably, merchants are quickly exiting Pepe, Bonk, and Shiba Inu positions, the place open curiosity has dropped a median of 70%.

Interestingly, solely 6.2% of Solana leveraged positions have been closed throughout this era, although SOL is among the greatest losers previously 30 days.

Solana Crypto Costs Below Strain: What’s Subsequent For SOL

Dropping open curiosity coincides with worth declines. Bitcoin could also be holding agency however is buying and selling under $100,000. Alternatively, Ethereum has but to crack $3,000, whereas Solana is down over 40% within the final month, falling from $295 to round $175—a key assist stage.

(SOLUSDT)

If Bitcoin costs recuperate, lifting altcoins within the course of, merchants might flock again, trying to capitalize on a potential resumption of the This autumn 2024 uptrend. Nevertheless, after the plunge in February and the overall apprehension—coupled with the belief that meme cash funneled capital away from high altcoins—merchants will probably stay cautious.

If, conversely, costs drop additional, with Solana shedding $150 and Bitcoin falling under $90,000, widespread panic promoting might ensue, resulting in the unwinding of billions value of leveraged trades.

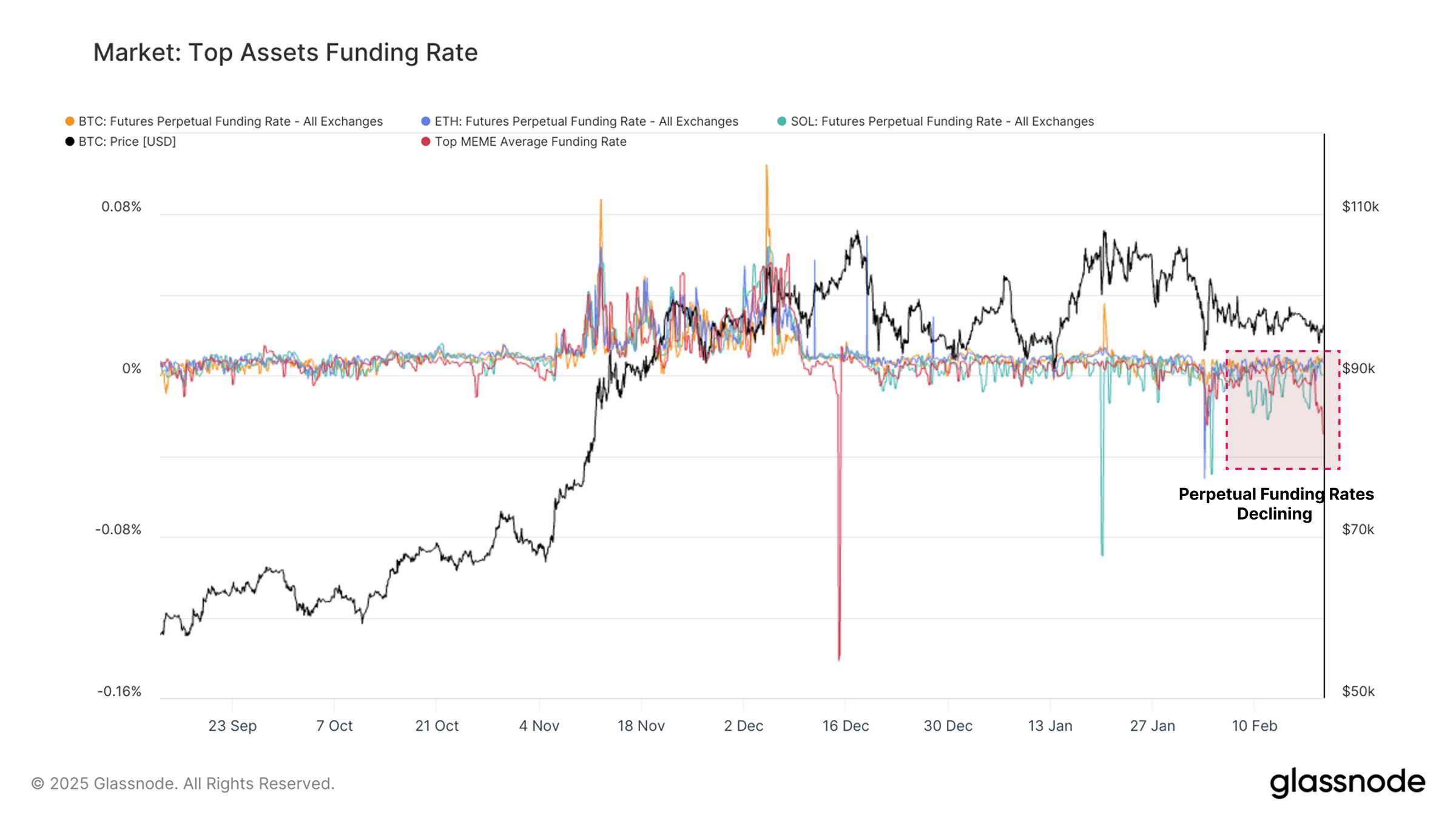

Reflecting this development is the drop in funding charges. Glassnode analysts observe that whereas Ethereum and Bitcoin funding charges are barely detrimental, leveraged merchants taking lengthy positions on Solana are being paid, as its funding fee can also be detrimental.

(Supply)

The shift from constructive to detrimental over the past month signifies extra merchants are exiting and unwinding their lengthy positions. Since exiting longs means promoting, this sell-off has been exacerbated, making a domino impact.

It stays to be seen how open curiosity will evolve within the subsequent few days. As of this writing, most merchants are impartial (42), based on the CoinMarketCap Worry and Greed Index.

(Supply)

Nevertheless, over the previous month, merchants have been principally fearful, with concern and anxiousness gripping the market since early February.

EXPLORE: 15 New & Upcoming Coinbase Listings to Watch in 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Meme Coin open curiosity falls by over 52%

- Crypto momentum fading, Bitcoin, altcoins, and meme cash retracing

- Meme coin open curiosity fall by 52% in a single month

- Funding charges additionally flip detrimental on main crypto perpetual exchanges

The publish Retailers Backing Off From Leveraged Crypto Trades: Meme Coin Open Interest Plunges 52% appeared first on 99Bitcoins.