Bulls stay in command of the broader cryptocurrency market as buyers’ optimism stays pegged on crypto-friendly coverage measures, heightened adoption of those digital property, and central banks’ strategic reserves. Even so, crypto majors have largely stalled within the absence of a direct catalyst.

Amid the pullback, meme cash and notably AI initiatives have proven immense development and indismissible alternatives. iDEGEN, a singular social experiment is one such challenge. Even earlier than hitting the general public cabinets, it has the potential to provide the likes of Fartcoin and AI16z a run for his or her cash.

Bitcoin’s below strain from bets on fewer price cuts

Bitcoin value rebounded on Tuesday after testing the essential help zone of $90,000 within the earlier session. As on the time of writing, the highest crypto was at $96,485 because it finds help alongside the 50-day EMA whereas hovering across the short-term 20-day EMA.

Whereas the bulls are nonetheless in management, increased Treasury yields have prompted a sell-off of riskier property like cryptocurrencies. On Monday, the benchmark 10-year Treasury yields rose to 4.80%, a degree final recorded in October 2023.

The stronger-than-expected US jobs knowledge launched late final week additional pointed to the Fed easing on its price cuts in 2025. Notably, riskier property like cryptos thrive in an setting of decrease rates of interest.

Within the close to time period, the vary between $93,010 and $97,500 shall be value watching. Past that degree, the bulls will possible face resistance at $98,500. On the flip aspect, a pullback previous the vary’s help zone may even see BTC/USD drop to $92,225.

Bitcoin value chart | Supply: TradingView

iDEGEN marks a brand new section for AI meme cash

As synthetic intelligence revolutionizes the crypto market, iDEGEN is marking a brand new period for AI meme cash. Actually, based mostly on its virality and potential, some analysts view it as a “Bitcoin equivalent”.

In contrast to different initiatives, it began on a clean slate with no restrictions or guardrails. By counting on degens to be taught, undertake, and formulate tweets, iDEGEN has developed right into a viral sensation whose development surpasses its creators’ wildest imaginations.

So aggressive is the motion that not even a ban on X may curtail it. Based mostly on its virality and energetic neighborhood, the challenge has the markings of a crypto that can evolve from being a mere joke to a billion-dollar asset.

With this immense potential, a rising variety of savvy buyers are amassing $IDGN tokens with only a few weeks left earlier than its itemizing on twenty seventh February. Since its launch on twenty sixth November 2024, the challenge has already raised over $16 million.

Early adopters are already sitting on hefty returns at its present value of $0.01. In comparison with its preliminary value of $0.00011, $IDGN holders have raked in 8,991% in returns. At this tempo, there aren’t any indicators of iDEGEN slowing down. Be taught extra about iDEGEN right here

Ethereum data surge in outflows amid a shift in investor sentiment

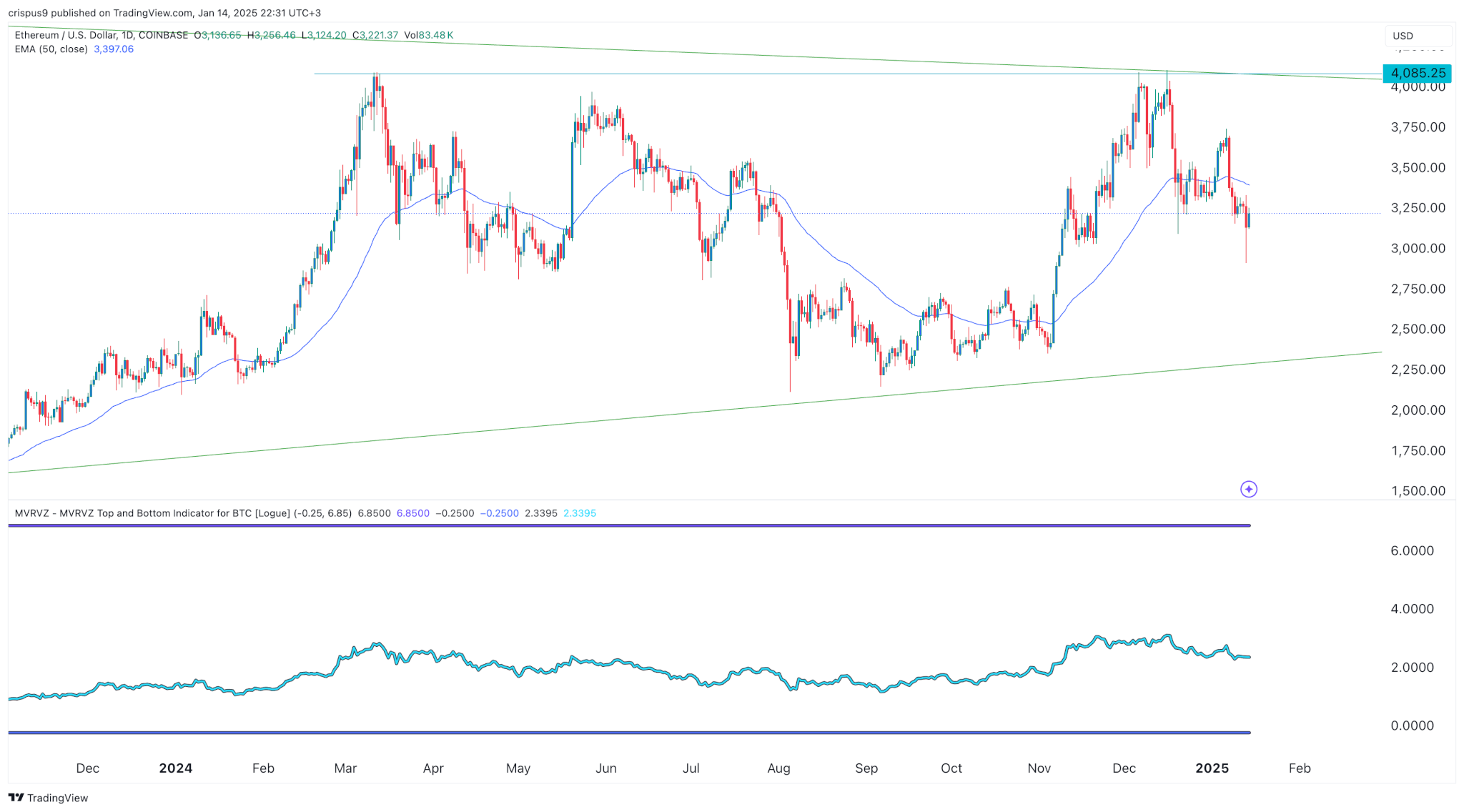

ETH value chart | Supply: TradingView

After the Bitcoin-led selloff that noticed Ethereum value momentarily drop under the essential zone of $3,000 on Monday, the altcoin rebounded to commerce at $3,191 as on the time of writing. A have a look at its day by day chart highlights the formation of the bearish dying cross with the short-term 20-day EMA crossing under the medium-term 50-day EMA to the draw back.

In addition to, ethereum value stays below strain from the latest surge in outflows. Based on SoSoValue, ETH spot ETF recorded day by day web outflows of $39.43 million on thirteenth January. Topping the checklist was Grayscale Ethereum Belief EFT (ETHE) with a day by day web outflow of $14.49 million and cumulative web outflows of $3.70 billion. On the similar time, its Mini Belief (ETH) had day by day web outflows of $37.84 million.

Within the close to time period, ethereum value will possible hover round $3,150 as bulls attempt to defend the help degree of $3,000. Even with furthe rebounding, it’ll possible face vital resistance at $3,320.